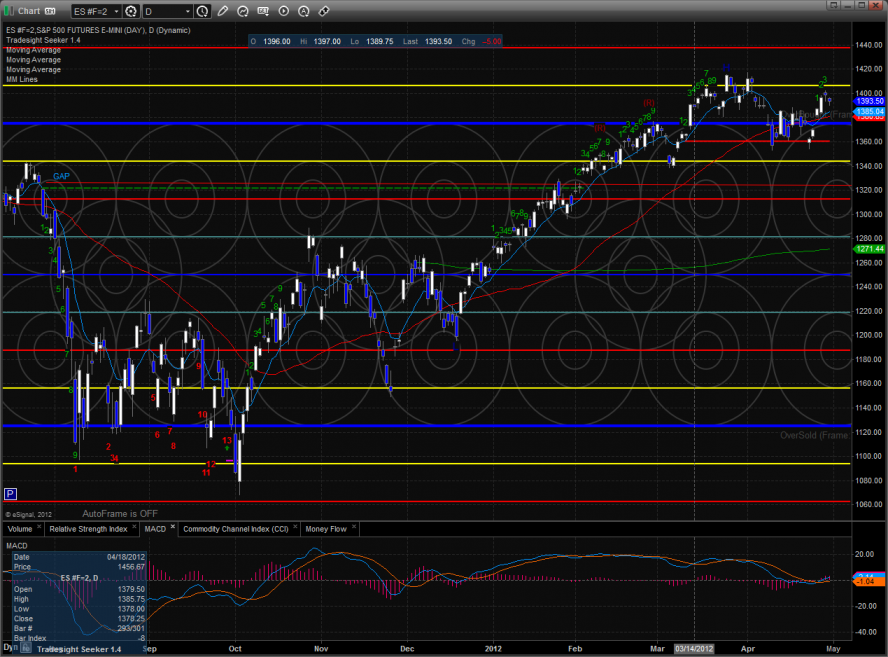

The ES capped off the month by losing 5 handles on the session. This could be a very important couple of candles because this mini-formation will either continue higher and take out the old high or will bearishly turn into a “B” wave retest that fails at the prior high. If the pattern fails to make a higher high and takes out the April lows then the bearish “B” wave scenario will be confirmed.

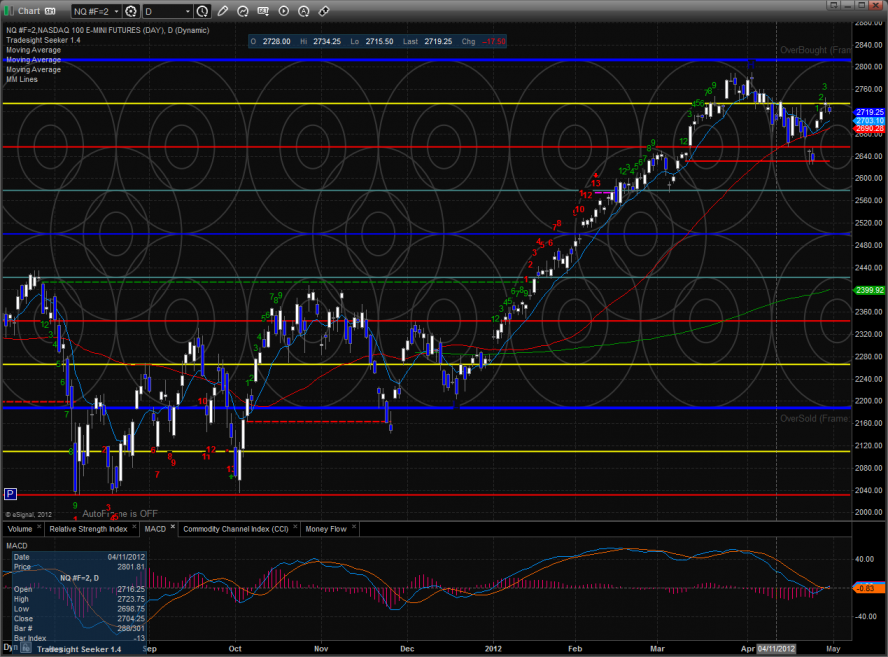

The NQ futures lost 18 on the day and has the same general design as the ES futures only with more relative strength. The same pattern is in play and the next few candles are critical.

The 10-day Trin is in the neutral zone:

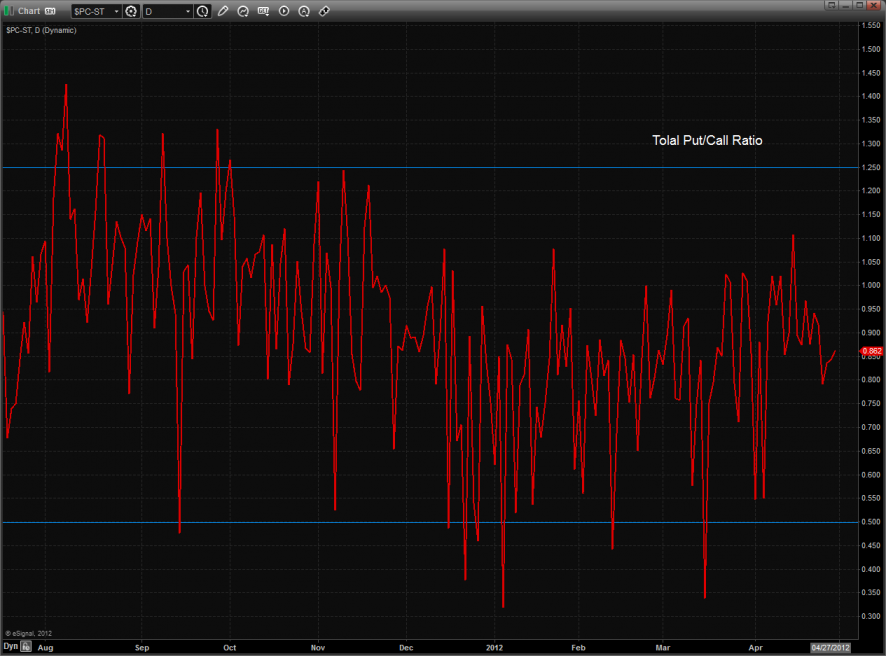

Like the Trin, the total put/call ratio is neutral:

Multi sector daily chart:

The Dow/gold ratio should be monitored here. A breakout over the 6.00 level will put the upper trend channel in play.

The BKX was bearishly decoupled from the broad market today showing relative weakness. Keep a close eye on this relationship. Underperformance of the BKX might be an early indication that “Sell in May” is in play.

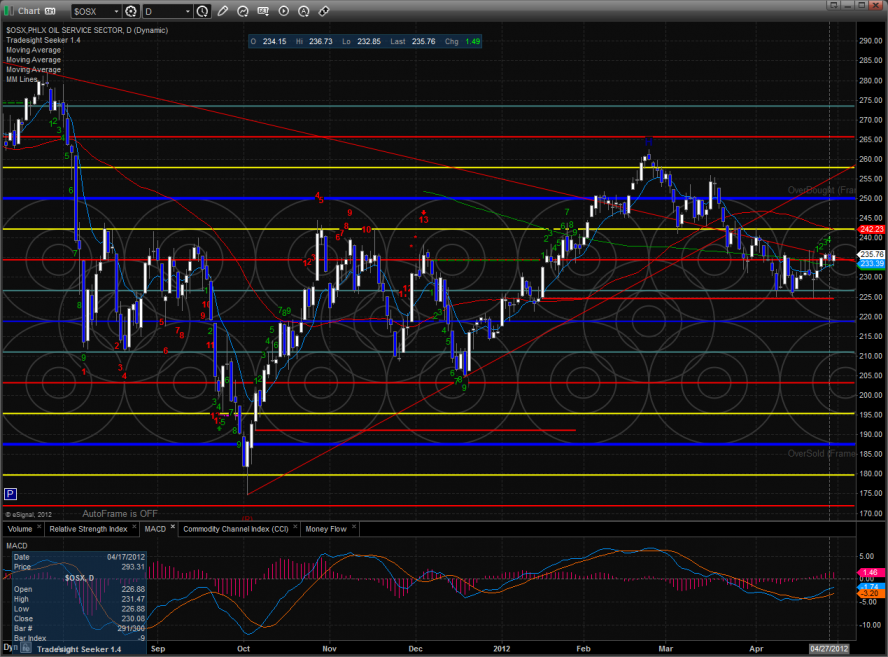

The OSX was the top gun on the day but was inside Friday’s range.

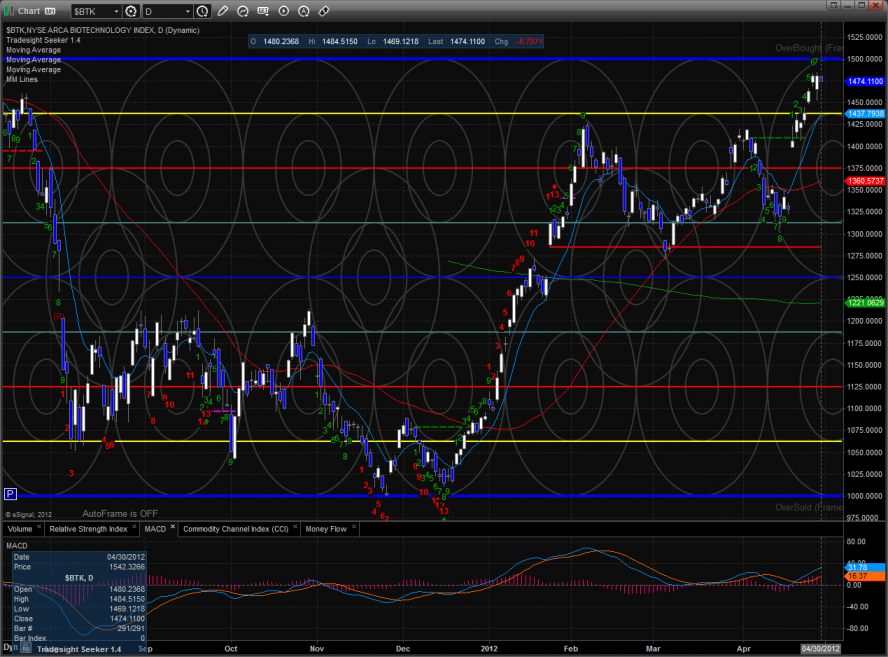

The BTK also traded inside:

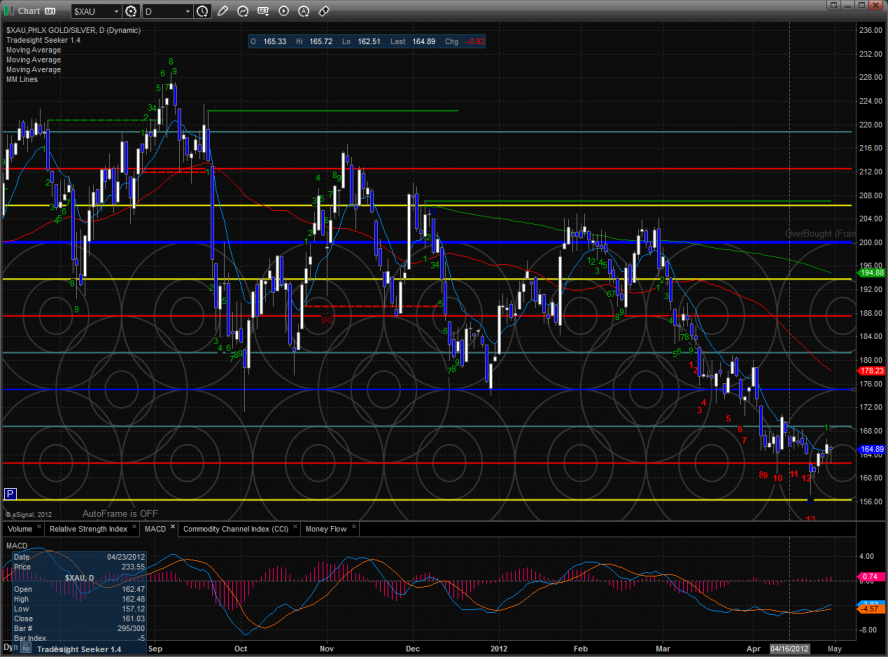

XAU inside day:

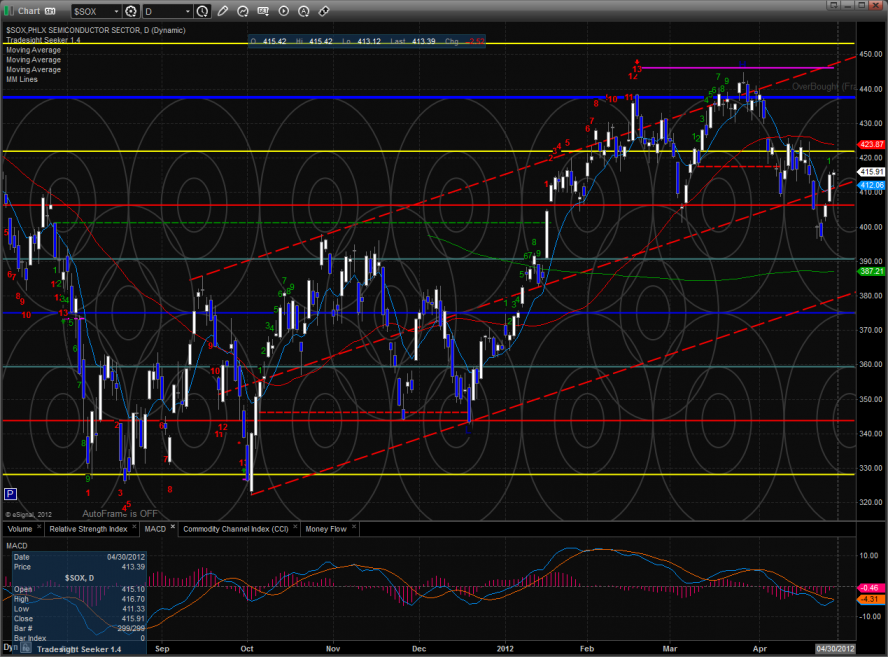

The SOX traded in-line with the NDX: