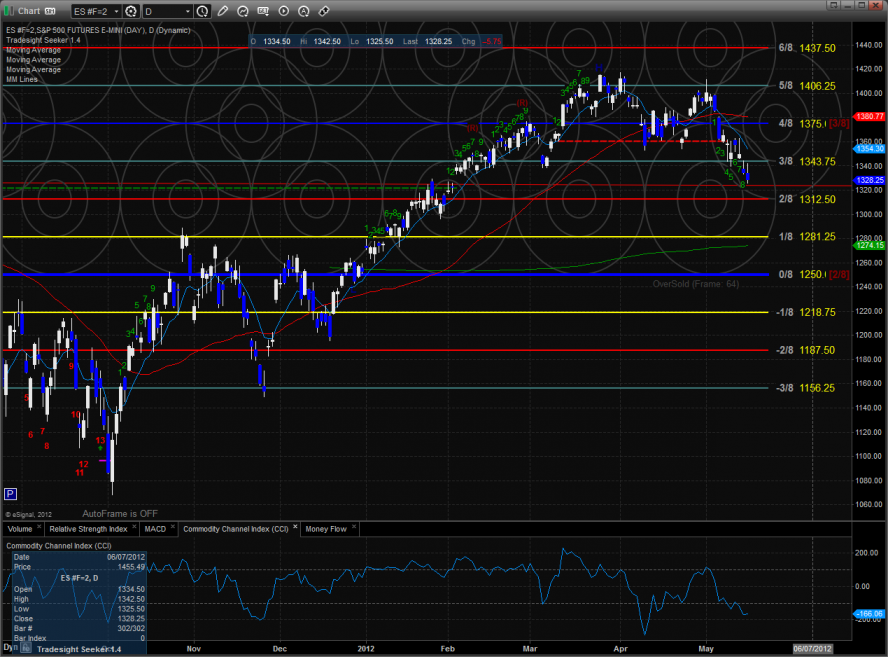

The ES lost 6 handles on the day making a new low on the move and a new low close. Note that the Seeker count is now 9 days down.

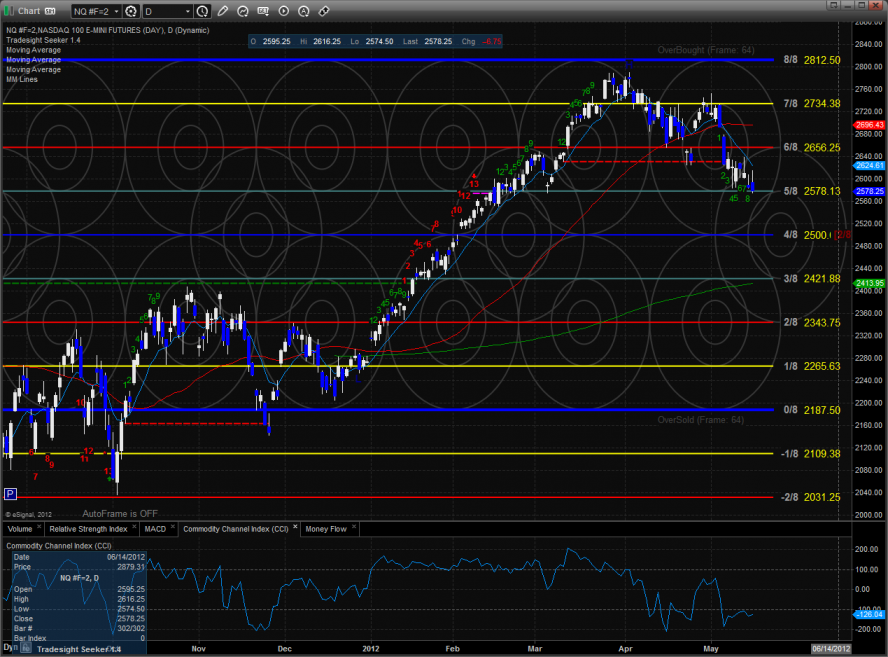

The NQ futures were also down on the day though were relatively strong vs. the broad market. Price did make a new low on the move but the pattern is finally 9 days down.

The 10-day Trin has matched the most oversold reading of the year to date.

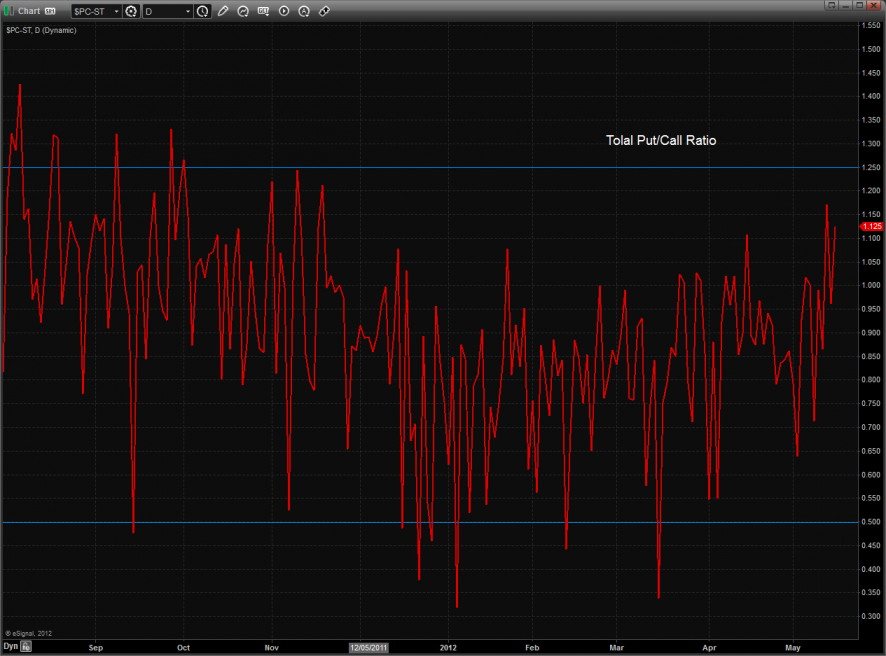

The total put/call ratio has yet to record a climatic close.

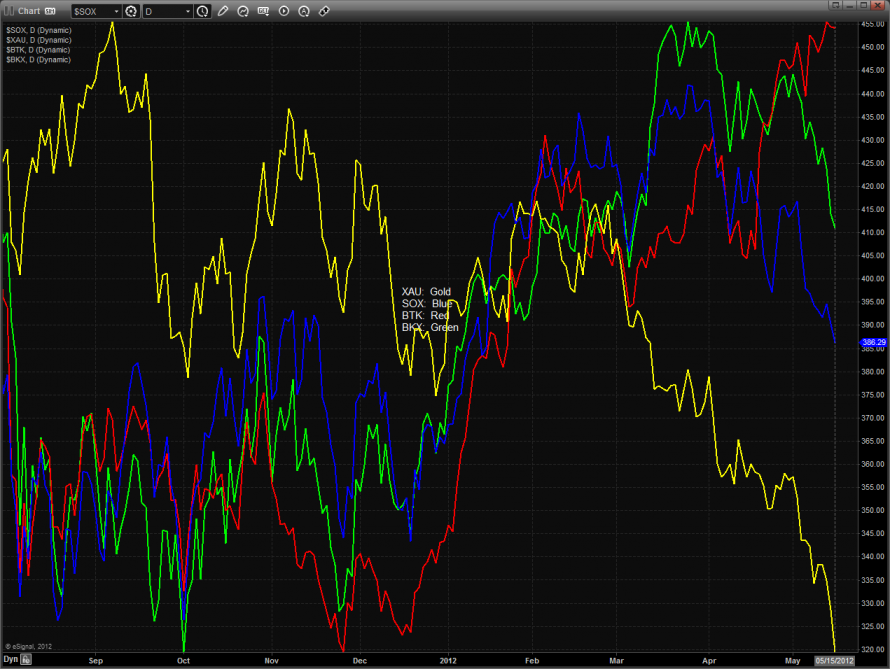

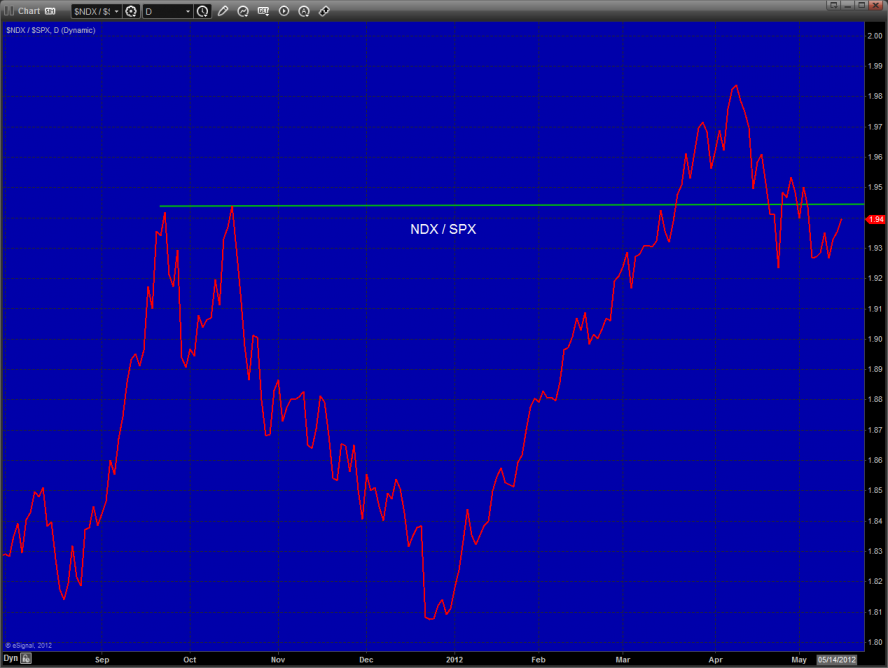

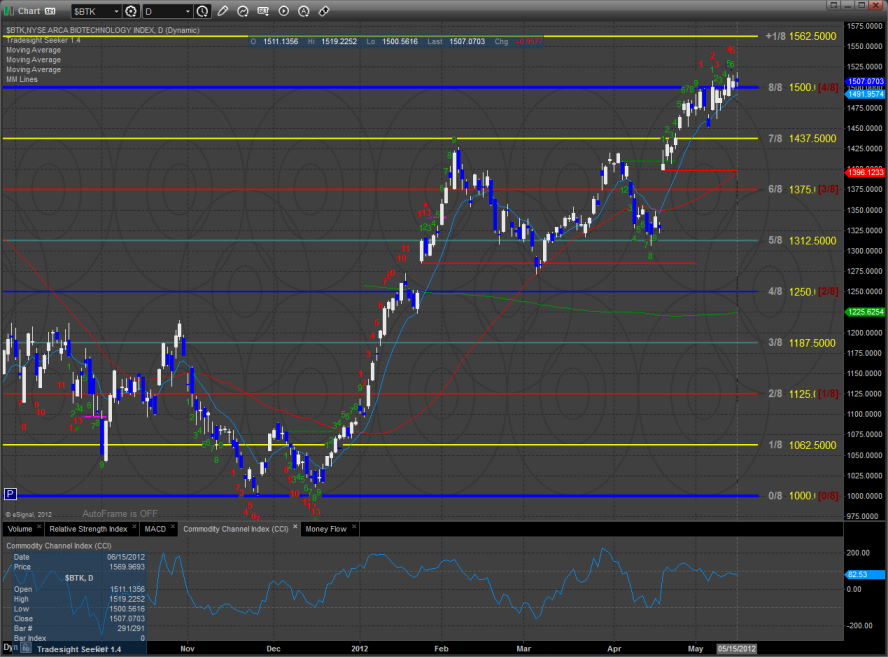

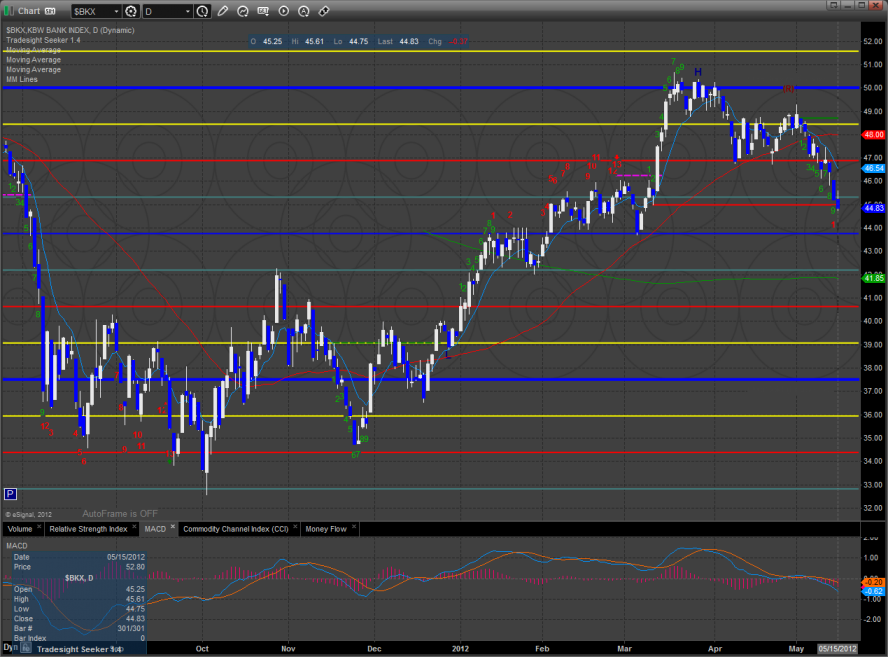

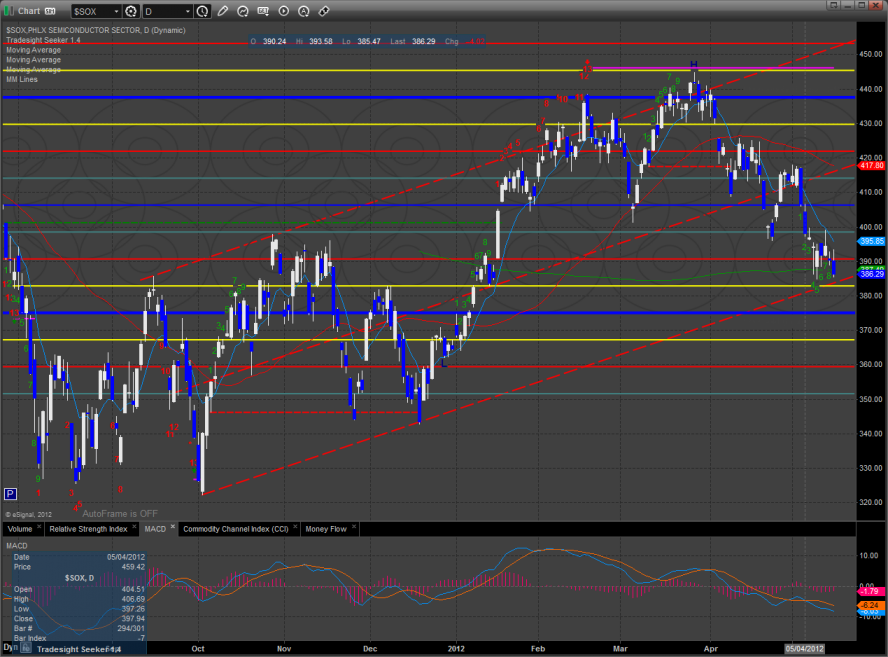

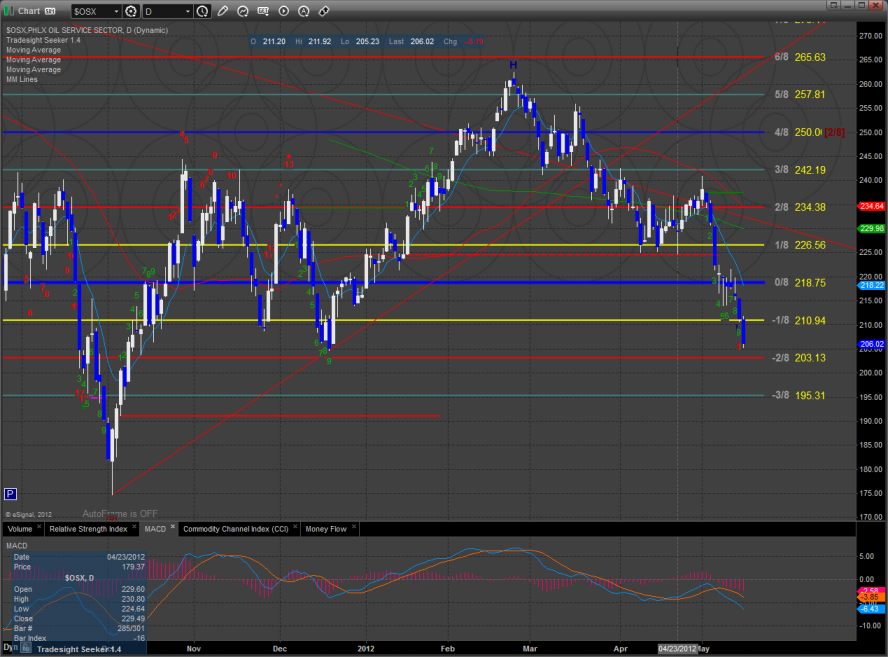

Multi sector daily chart:

The NDX/SPX cross ratio chart shows that the NDX bullishly still has relative strength vs. the SPX.

The BTK was the top gun on the day and is still controlled by the 8/8 level.

The BKX closed just below critical support which doesn’t quite yet qualify as a break of the static trend line.

The SOX is 9 days down into a super key area of support.

The OSX is moving deeper into oversold territory. Keep a close eye on the -2/8 level which is the last line of defense before a frame shift.

Oil:

Gold:

Silver: