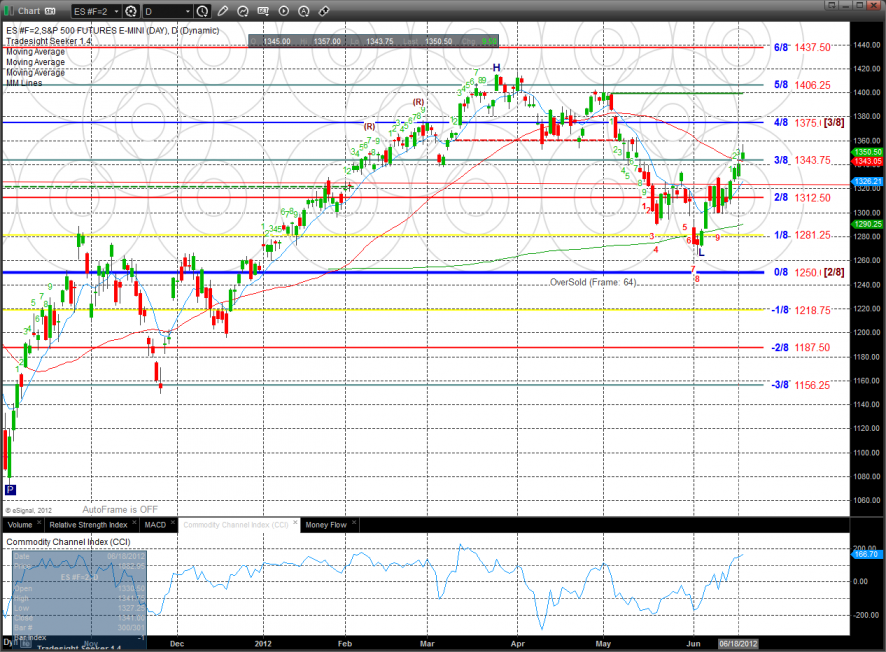

The ES settled above the 50dma for the first time since April, gaining 10 on the day. The next challenge for the up move will be 1375.

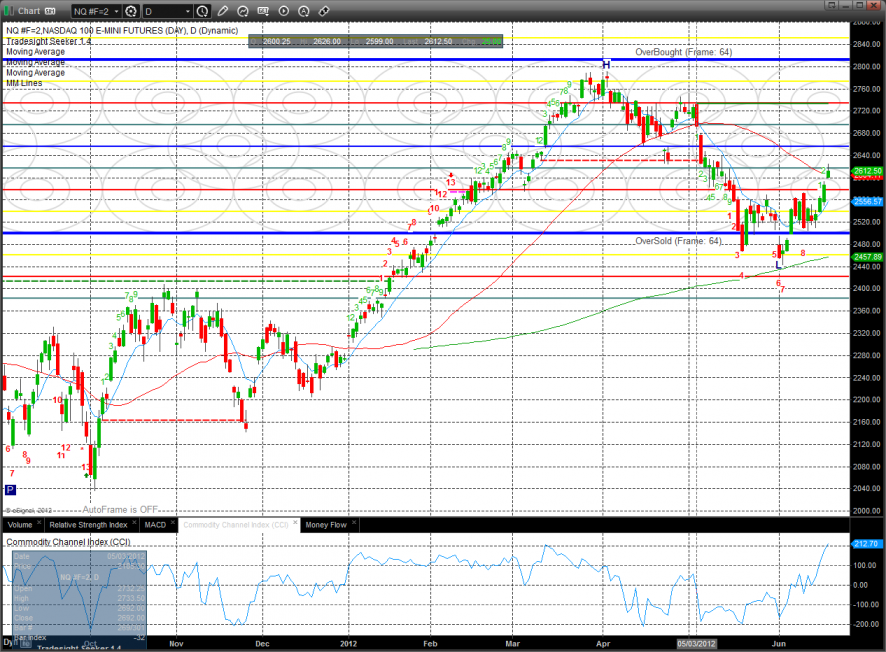

The NQ futures were higher by 25 on the day and settled above the 50dma.

The 10-day Trin has more room to go before recording an overbought reading.

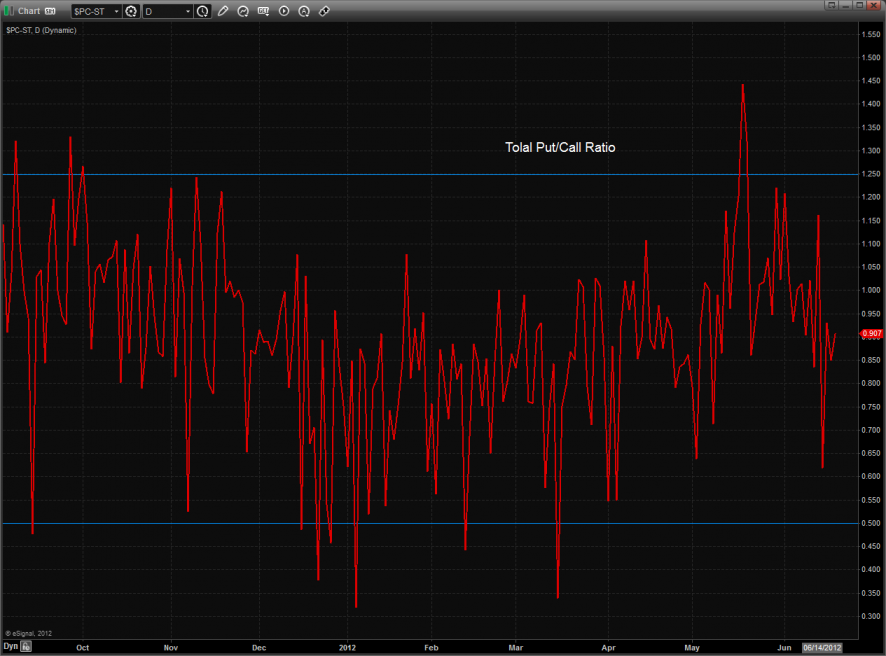

The total put/call ratio is still neutral:

Multi sector daily chart:

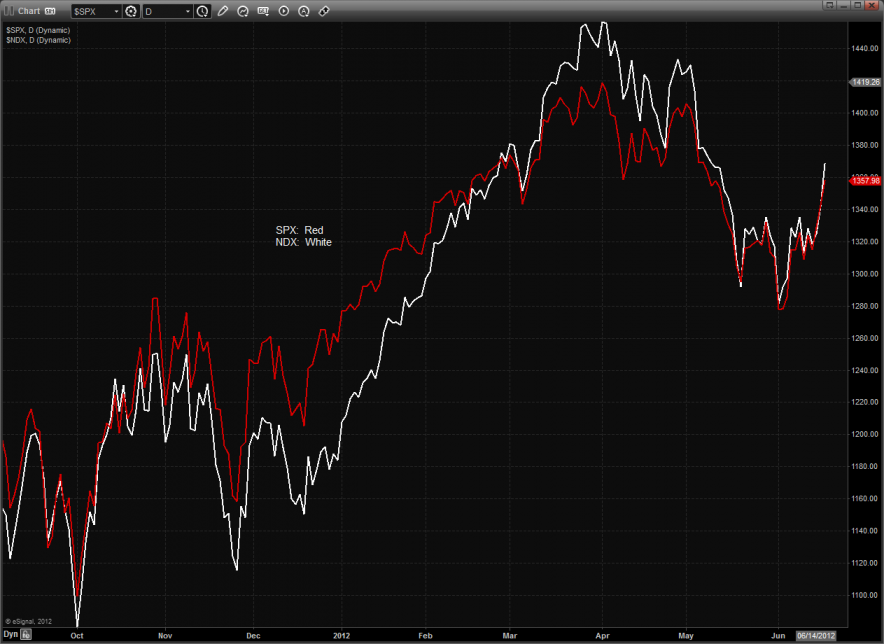

The SPX/NDX cross shows that the NDX continues to hold a bullish relative strength advantage.

The OSX cross was the top gun on the day but continues to lag the overall broad market in performance. Note that the Seeker buy countdown is still incomplete.

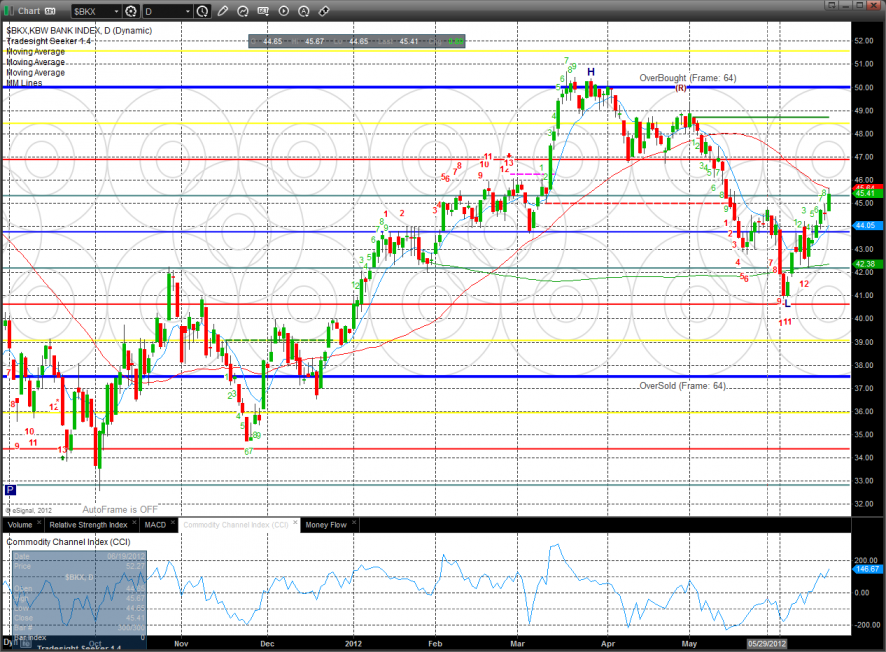

The BKX was up a full 2$ but is now 9 days up in the Seeker count and below the 50dma.

The SOX had an elusive very positive day. The pattern has nicely gapped above the reverse H&S neckline and a qualified follow through would be very positive for the overall market.

Oil:

Gold:

Silver: