After the fed meeting and announcement the ES was unchanged on the day. This leaves an indecisive doji at range high of the move. Price remains above the 50dma and the Seeker count is only 5 days up.

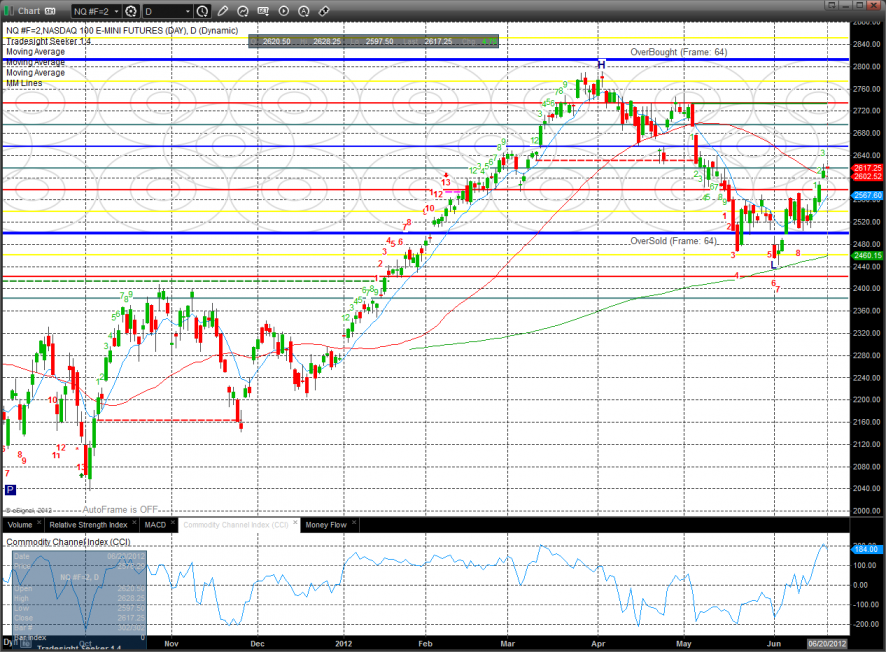

The NQ futures also doji’ed and settled up 5 handles on the day. So, both the ES and NQ futures did little on the day which leaves the door open to a nice post fed meeting move on Thursday.

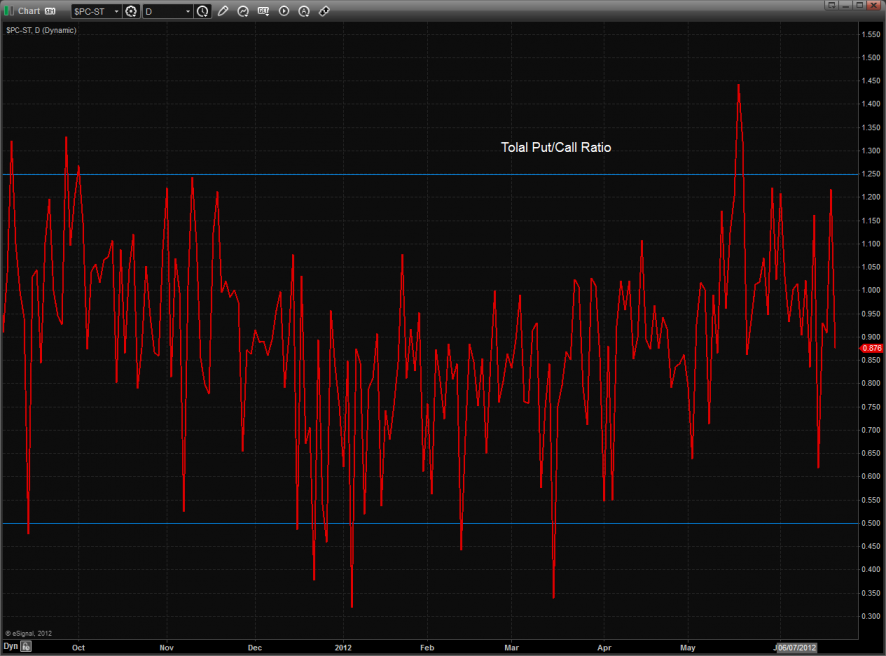

The total put/call has returned to the comfort zone.

10-day Trin remains neutral:

Multi sector daily chart:

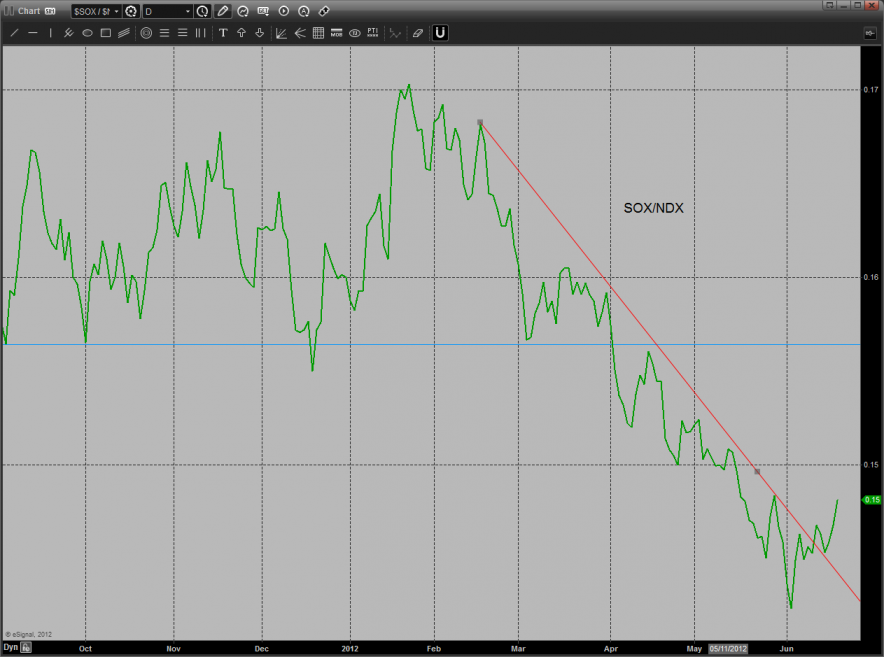

The SOX/NDX chart is possible making a bullish turn in favor of the SOX.

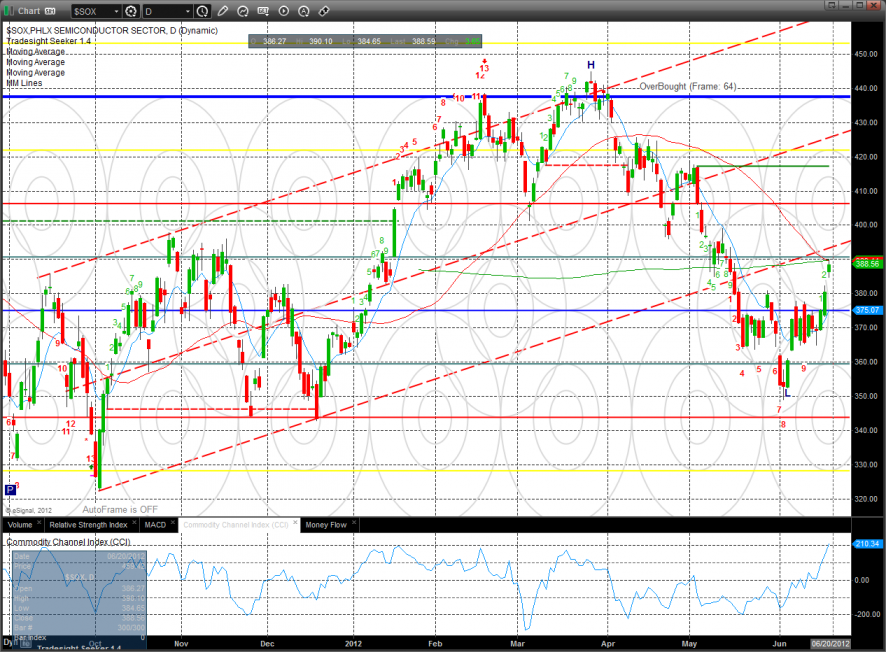

The SOX was the top gun on the day and has broken above the reverse H&S neckline. The next challenge for the SOX will be the 50dma.

The BKX was up marginally on the day and is hitting key resistance at the 50dma.

The OSX was the sore spot and continues to bearishly lag the overall broad market. The Seeker exhaustion is still on deck.

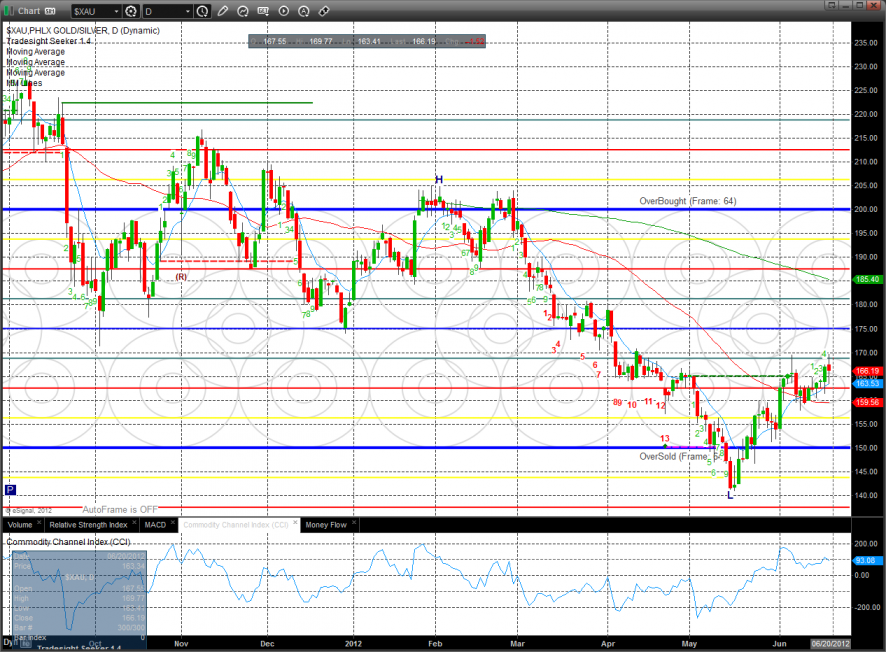

The XAU was the last laggard on the day and a source of funds. The index was lower on the day by 1%.

Oil made a new low close on the move and is 12 days down in the Seeker count and one day away from an exhaustion reversal.

Gold:

Silver: