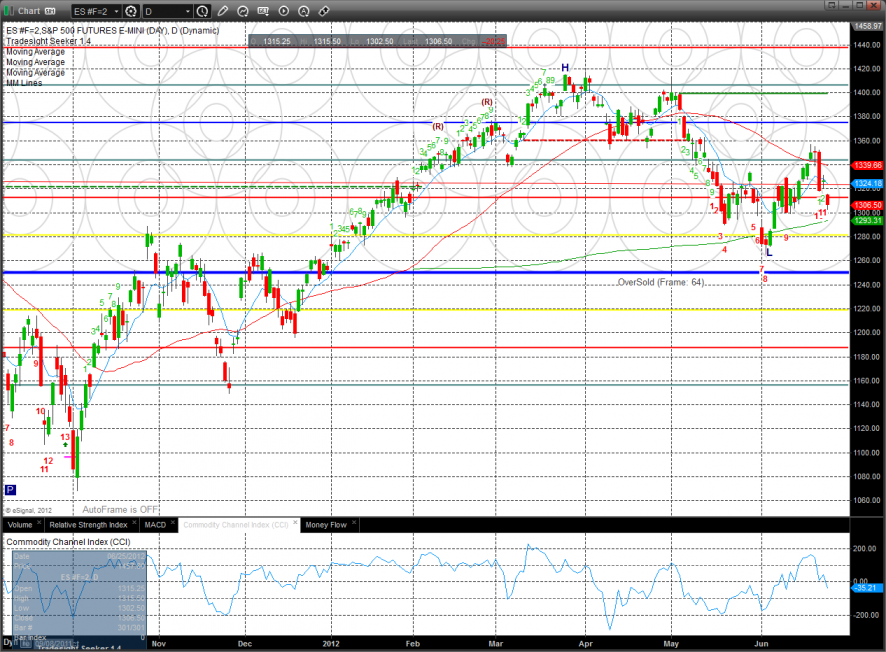

The ES lost 20 handles on the day putting it back to short term negative and well below the two prior highs.

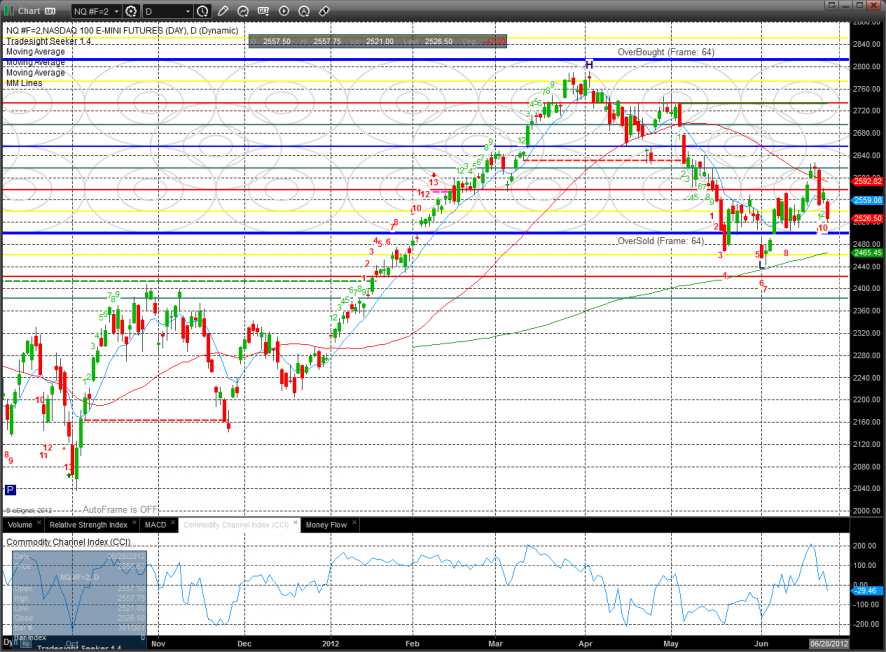

The NQ futures lost 47 on the day and are again short term negative. The 0/8 Gann level is key support and then there is the 200dma below that.

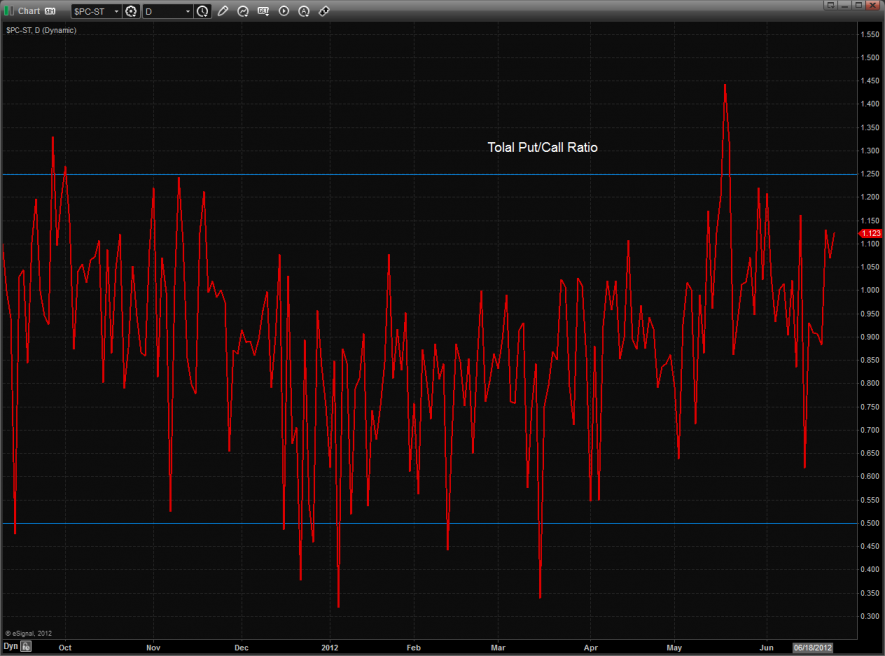

The total put/call ratio is climbing but not yet overbought.

The 10-day Trin is still over sold and loaded with potential reversal energy.

Multi sector daily chart:

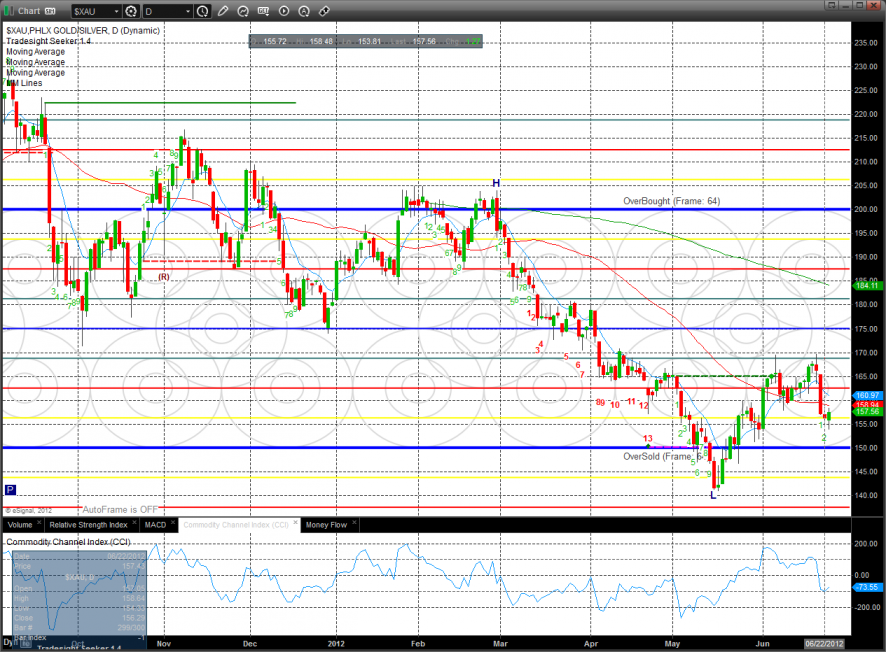

The defensive XAU was the top gun on the day and the only sector that was green.

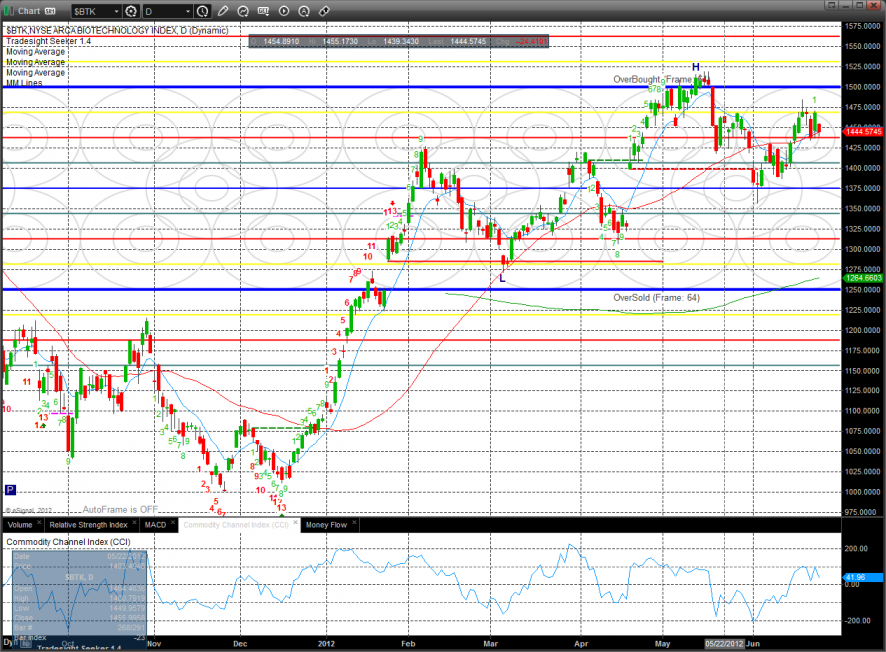

The BTK was lower but held above the important moving averages.

The OSX was a huge loser on the day and settled below the 0/8 Murrey math support level. Keep in mind that it’s not a break until after a follow through day has occurred.

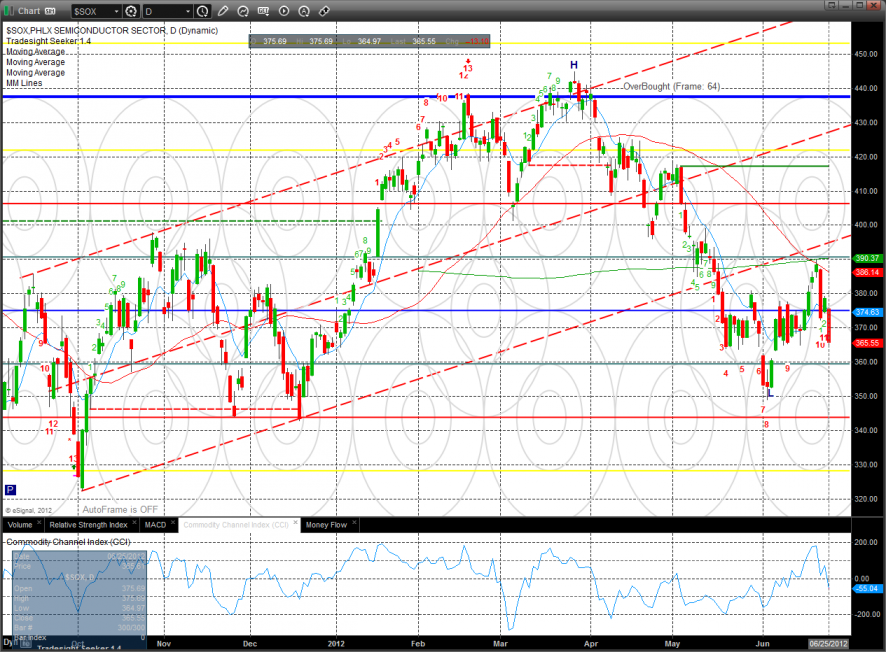

The SOX was the last laggard on the day losing 3.5%. This pattern is now 12 days down into the Seeker countdown.

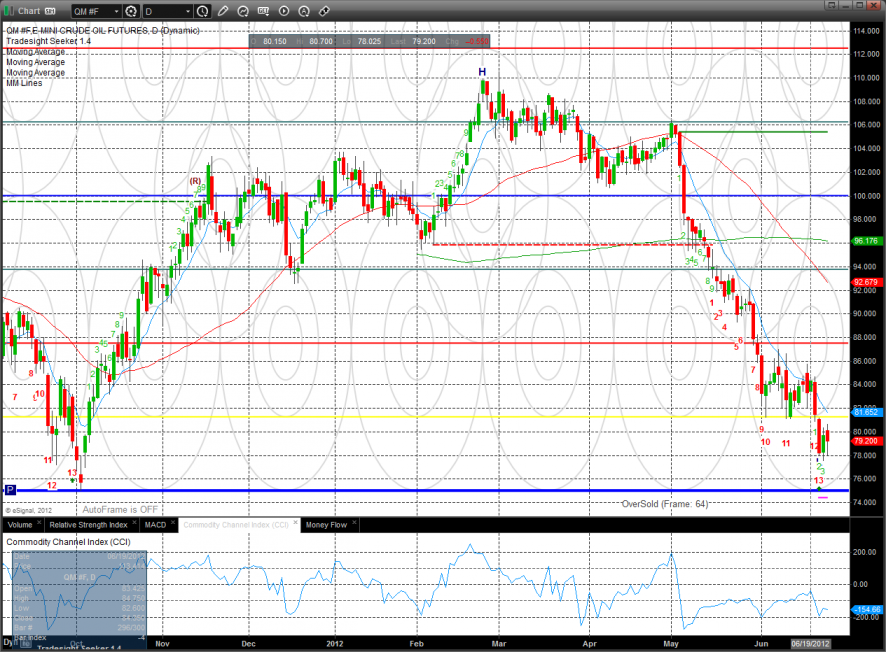

Oil:

Gold:

Silver: