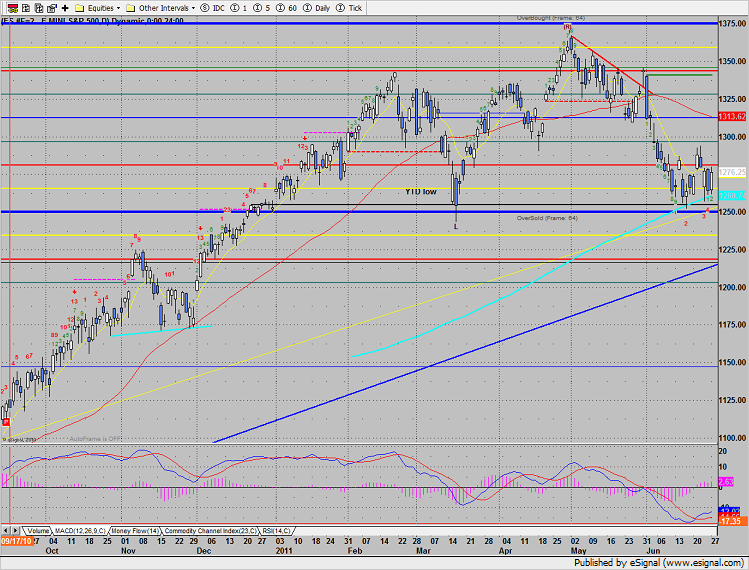

The SP again tested and held the 200dma. The futures added 12 on the day but have yet to clear the 3 day range that they have now been trapped within. Keep in mind that end of quarter window dressing begins midweek.

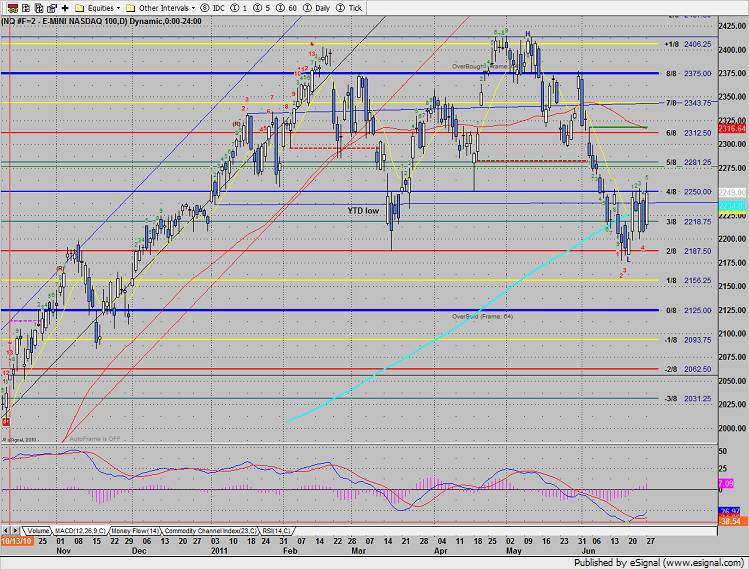

On a relative basis the Naz was much stronger than the broad market. Monday, the Naz gained 41, closing at a multi day high. Note that the oscillators have turned positive. A settlement above the 4/8 level should kick in upward momentum.

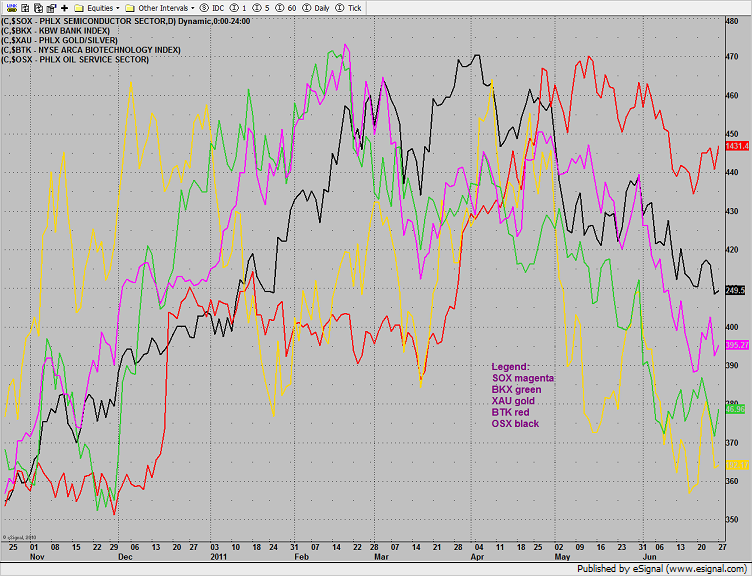

Multi sector daily chart:

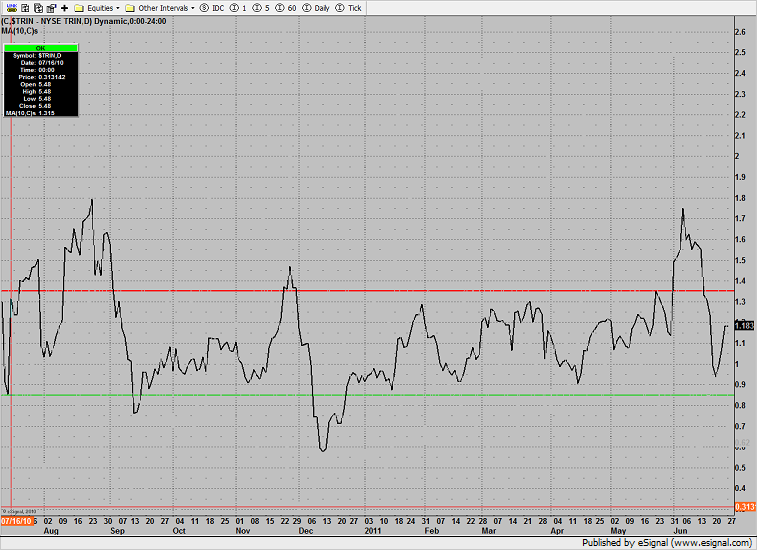

The 10-day Trin is neutral:

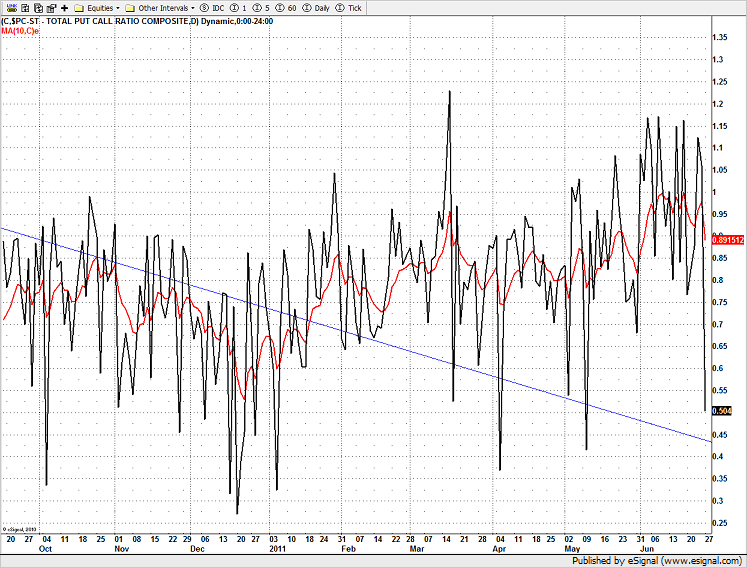

The put/call ratio recorded a near extreme reading:

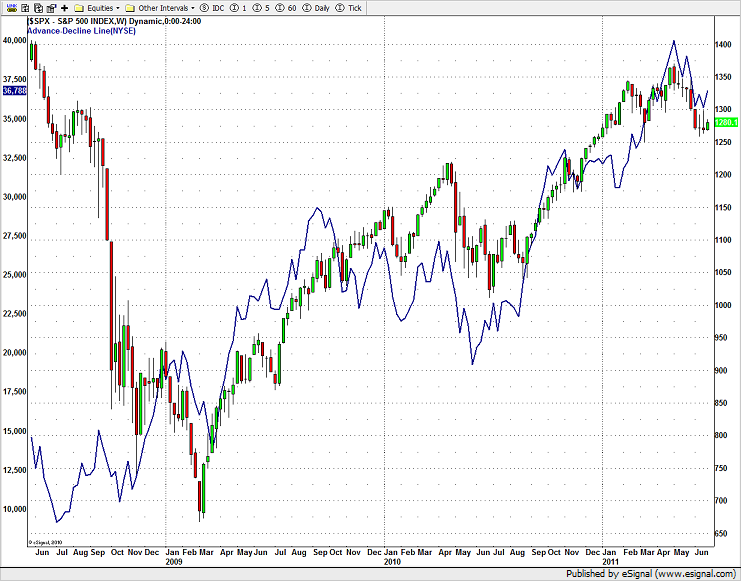

The weekly NYSE cumulative advance/decline line remains very constructive and long term bullish for traders.

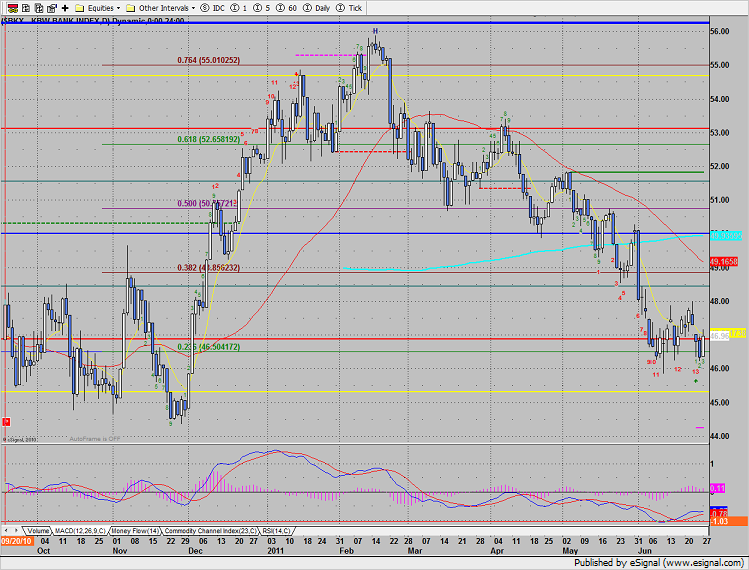

The BKX was top gun, note the Seeker buy signal that registered late last week.

The SOX was weaker than both the broad market and the Naz.

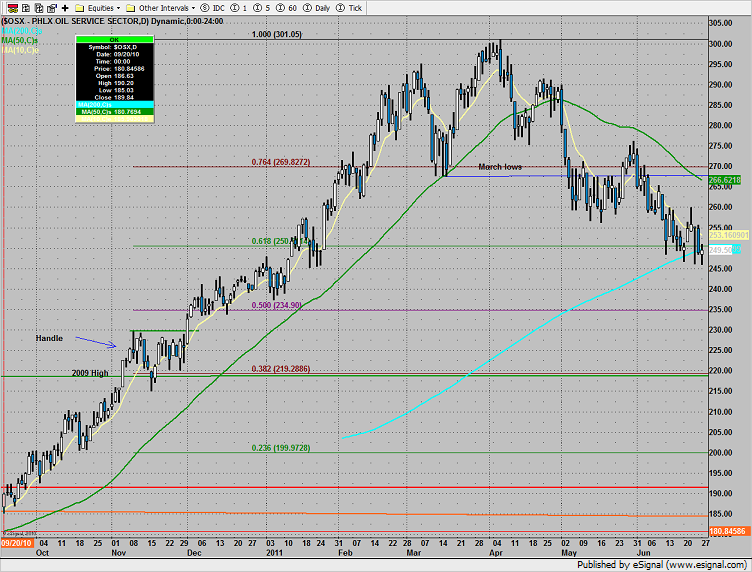

The OSX recouped steep midday losses and settled right at the 200dma.

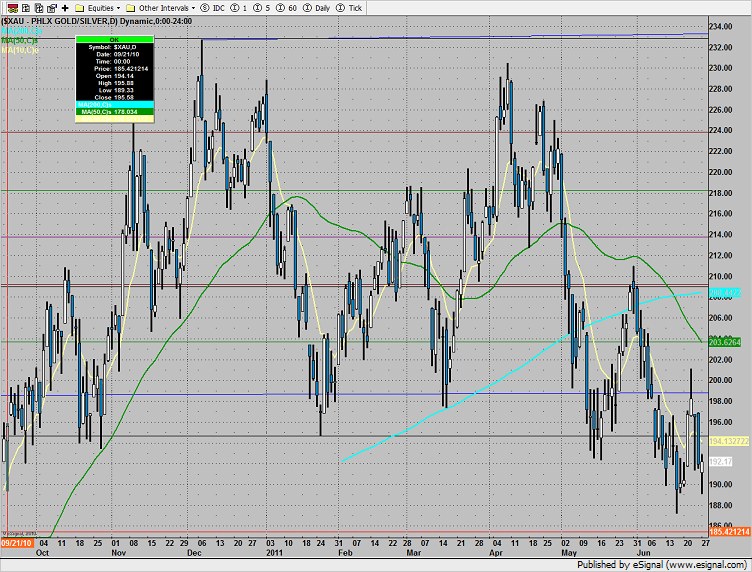

The XAU was the last laggard on the day and a source of funds.

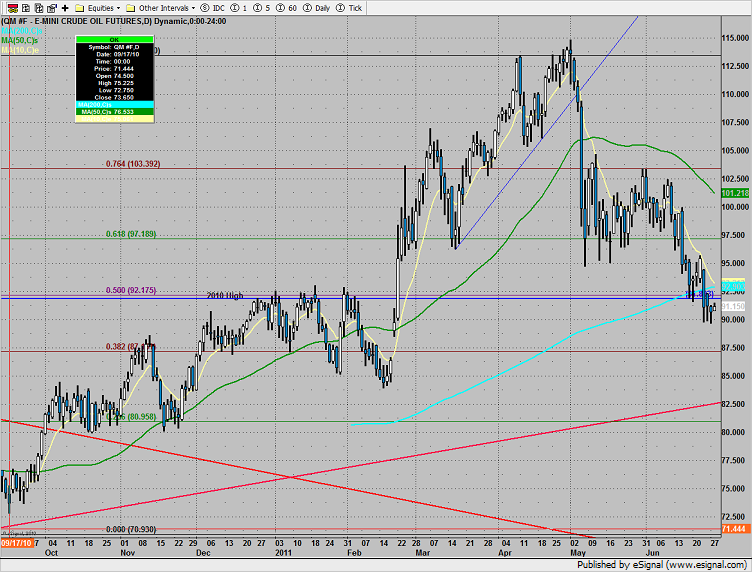

Oil still has a downward bias:

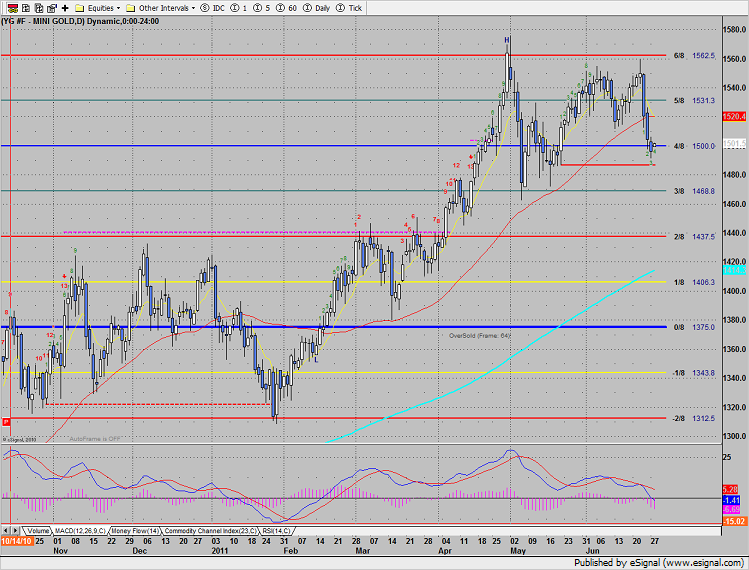

Gold is gaming 1500 level. Note that this is the 4/8 level.