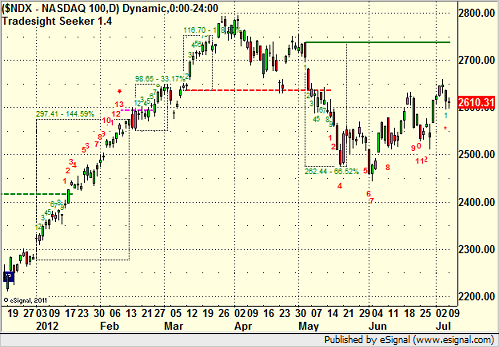

The NDX lost 2 points on 1.3 billion NASDAQ shares, a very weak volume day. Note that for those that understand the Tradesight Seeker tool, technically, the NDX had a 13 buy signal on Friday, although if you use the “8 bar qualifier,” it did not meet that criteria:

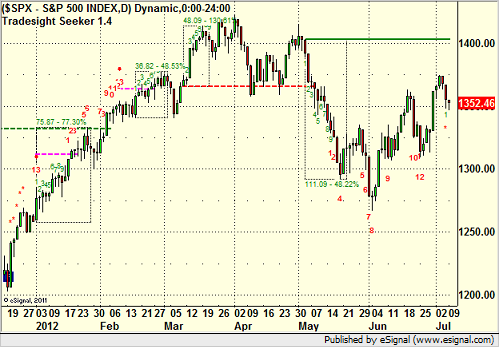

Even more interesting is that the S&P (down 2) did the same with what would have been a 13 buy signal on Friday, but the asterisk shows up in its place with the qualifier because we were not under bar 8. The reason that this is interesting on the S&P is because bar 8 is the low day back at the beginning of June, so we would have to get all the way under that bar and close one day to get the ultimate 13 buy signal, which is strange to see:

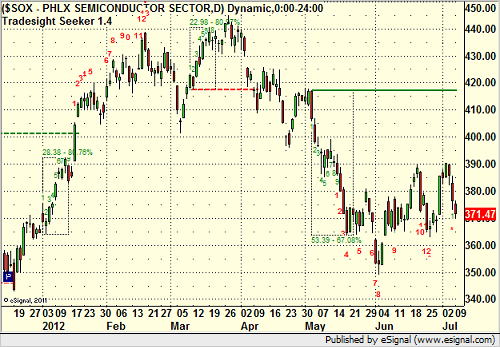

The SOX lost 5:

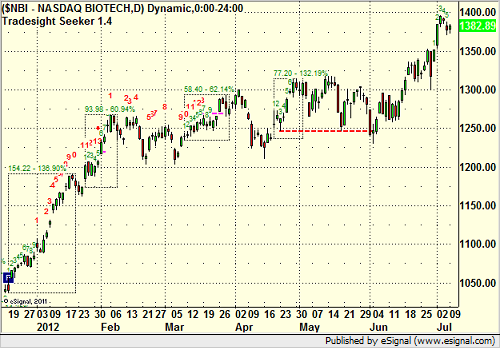

NBI gained 7:

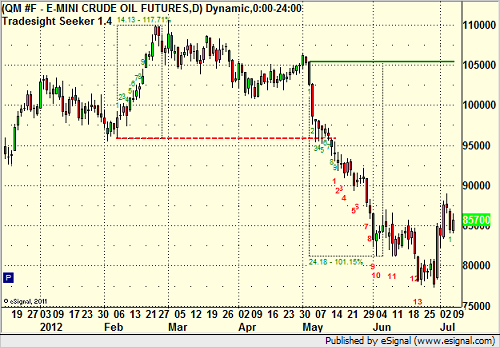

Oil closed at $85.72, and it is interesting here to see the decline since May (a strange time of year for price declines in oil, but perhaps a function of a weaker global economy). Also, note the 13 buy signal over a week ago that led to the current rally:

All of the above being said, July is usually a great trading month in terms of market volatility. We had very green trading sessions on Friday and Monday, but that was despite the weak volume in the market. Now that the Holiday is behind us, we’re going to need to see that volume pick up if we want a chance to see the rest of the month play out good.