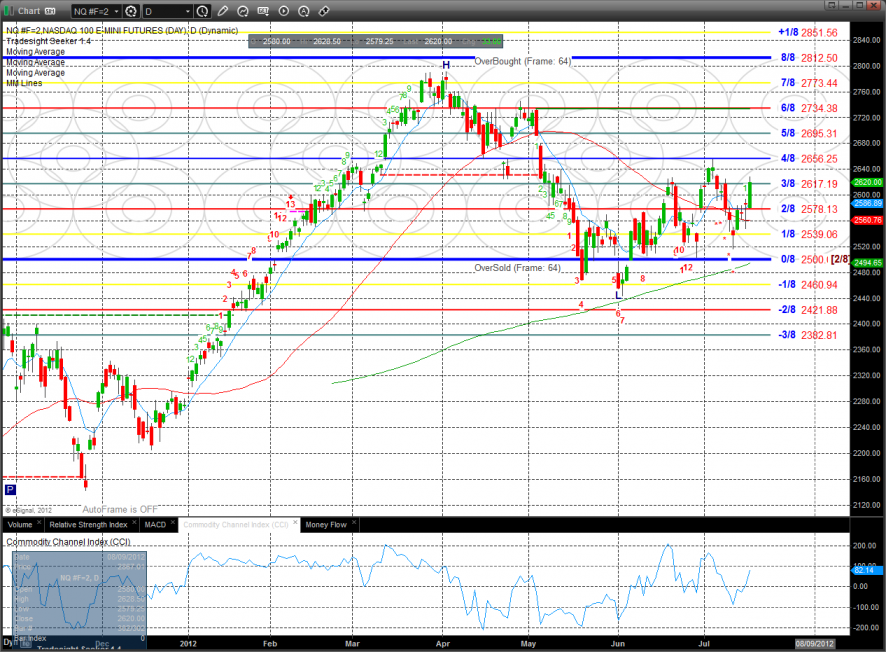

The NQ futures were higher on the day by 33 handles easily topping the relative performance from the SP side of the market. Price settled just below the prior high water mark on the move. The next critical overhead that will come into play is the 4/8 Murrey math level.

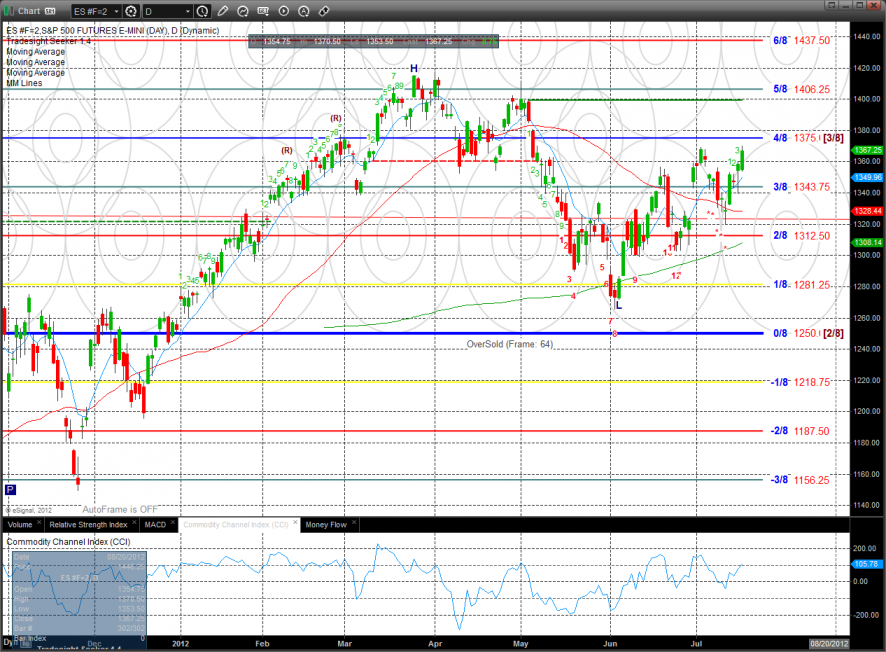

The ES was higher by 9 on the day and is in a very similar technical condition to the NQ. The Naz has been trailing the SP side so an overall bullish move in the market will need to have the Naz side get involved.

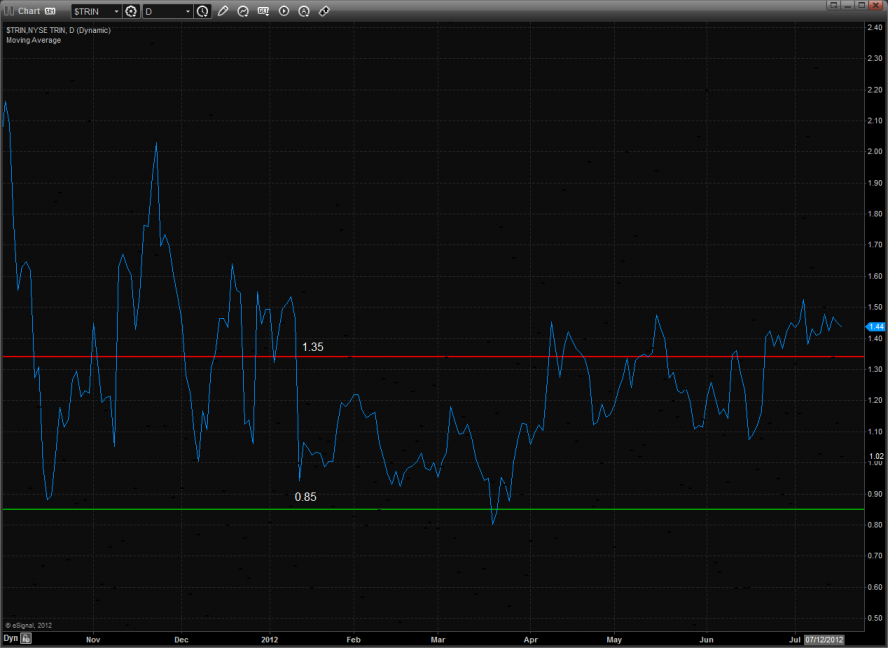

The 10-day Trin still has oversold energy:

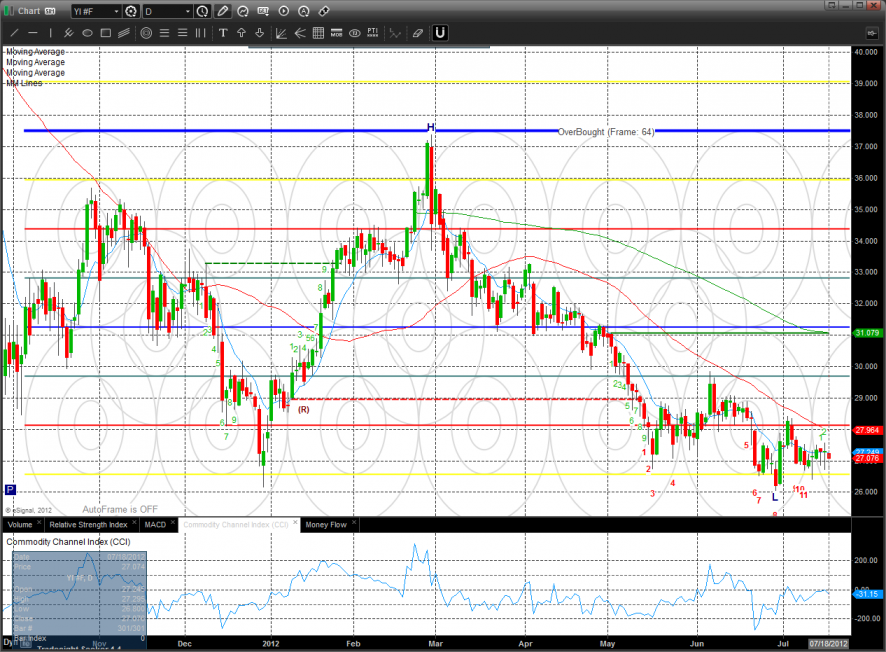

Multi sector daily chart:

The Dow/gold ratio is on the verge of a bullish breakout. This means that investors are favoring equities over the defensive alternate asset gold.

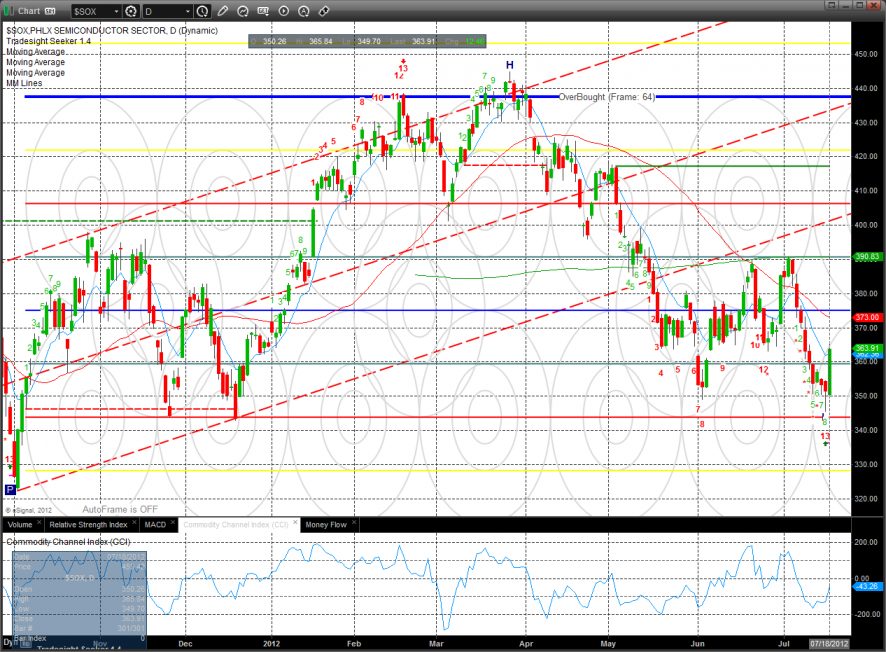

The Sox was the top gun on the day making good on the Seeker exhaustion signal put in place yesterday. Keep a list of long ideas handy and be ready to be aggressive on Friday after a measuring day Thursday.

The OSX is approaching the neckline of a reverse H&S pattern. Be patient and wait for it to setup.

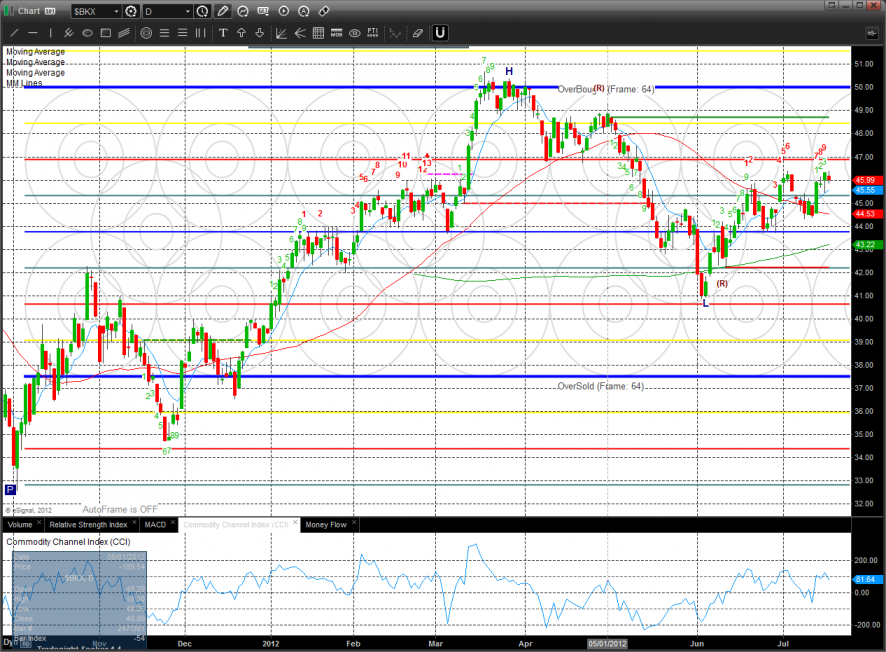

The BKX was weak all day and was the big drag on the relative performance of the SP Wednesday. The trend remains positive but note that the CCI is diverging which is a warning for the bulls.

The defensive XAU was the last laggard on the day and is now 9 bars down in the Seeker setup phase. Possible lateral consolidation or bounce in the next couple of trading days should be in the cards.

Oil:

Gold:

Silver: