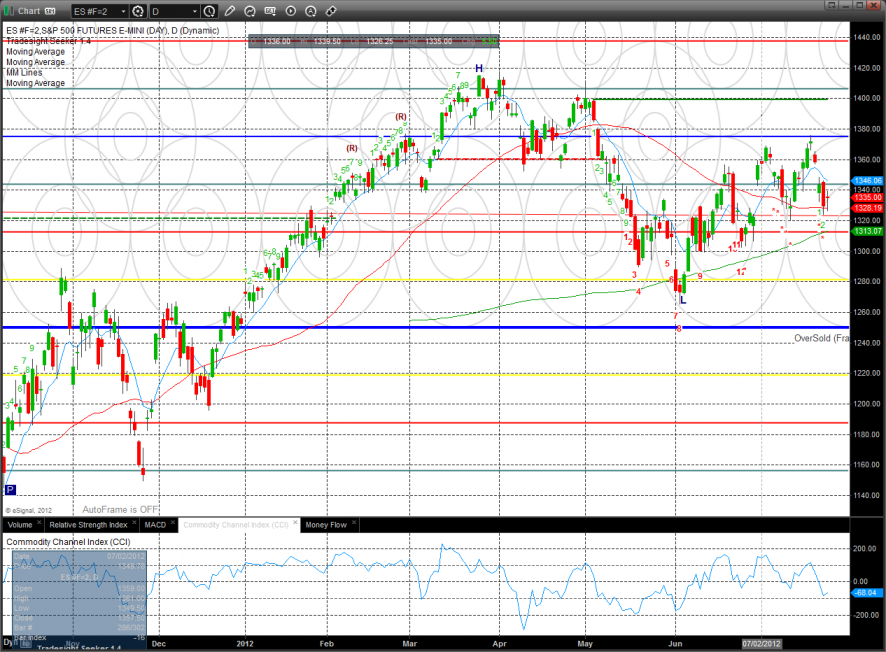

There is nothing new technically in the ES because it traded inside the prior day’s range. The futures gained 5 on the day but it means little when range bound. Options unraveling remains to be seen.

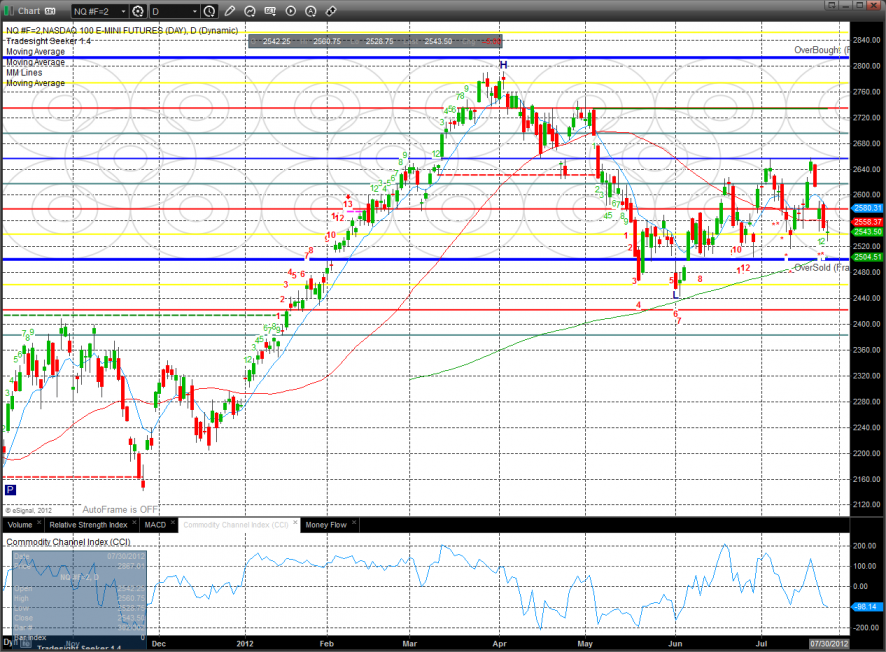

The NQ futures were lower on the day but posted a camouflage buy signal by closing above the open. The upward trend channel remains intact.

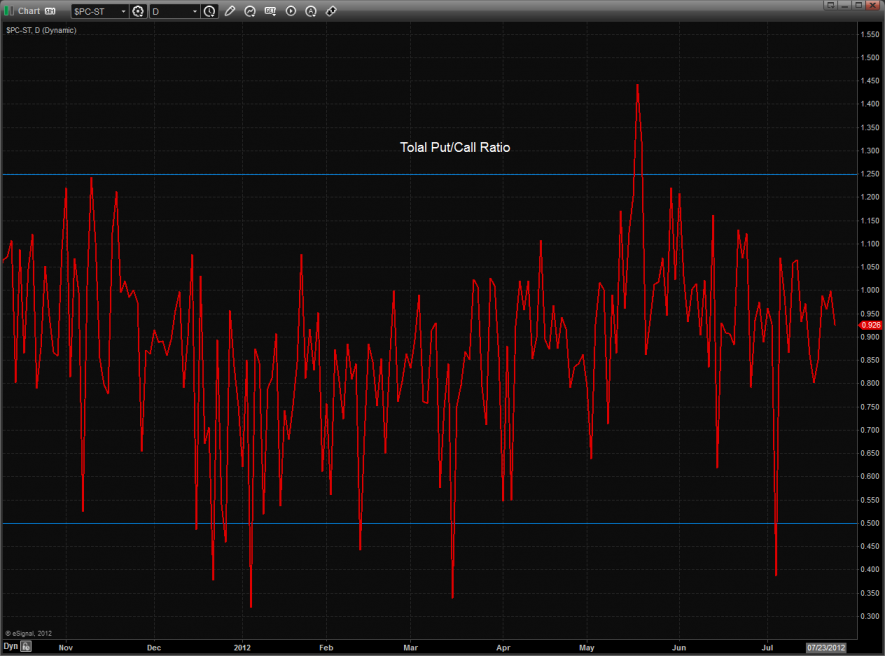

Nothing doing in the total put/call ratios as it remains neutral.

The 10-day Trin is pretty much in the neutral zone:

Multi sector daily chart:

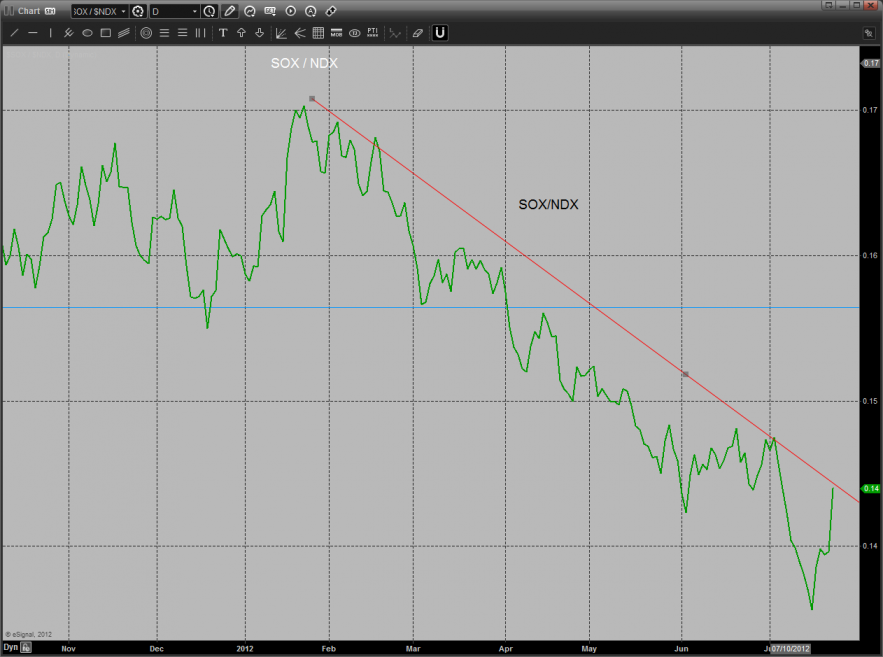

The SOX/NDX is at the door or a very bullish reversal:

The strength of gold made the Dow/gold ratio take a hit.

The defensive XAU was the top gun on the day not quite recording a key reversal day.

The SOX gapped higher and held it. Keep in mind that there is an active Seeker reversal on the chart:

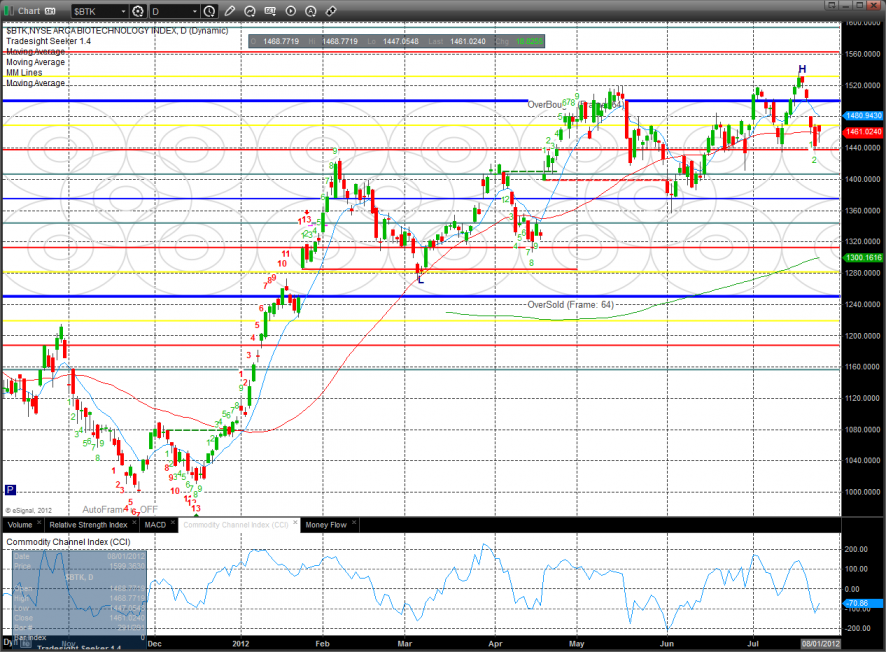

The BTK posted an inside day.

The BKX had relative strength but is still confined within the general 3 day trading range. Price is on the north side of all but the 10ma.

The OSX was the last laggard of the major indexes. Note that there is still room in the bar count for more upside.

Oil:

Gold:

Silver:

The TLT closed at a new high on the move and disqualified the Seeker sell signal. This instrument appears to be in the blow-off stage which can always run very, very far.