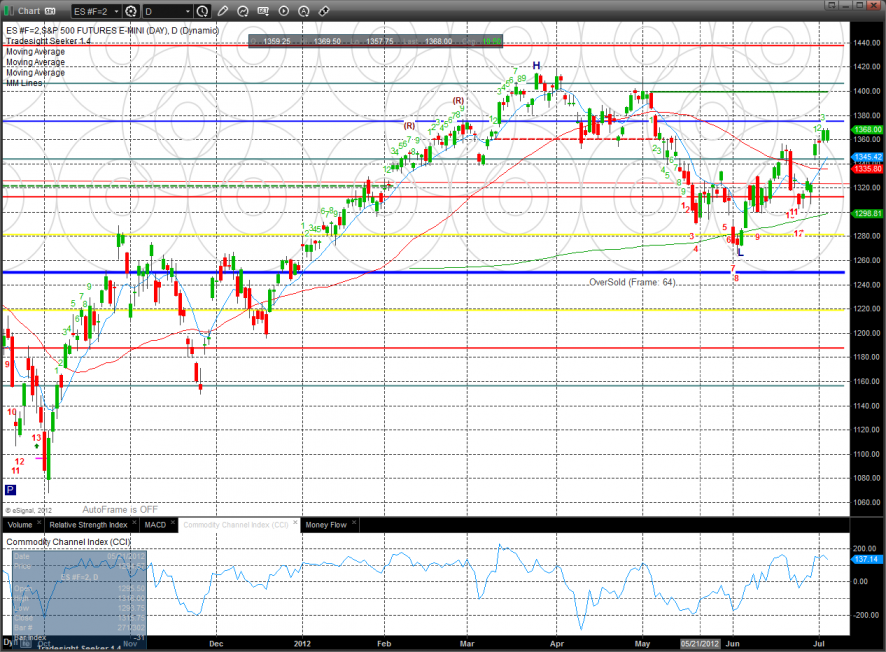

The ES posted a relatively inside day where a 10 handle gap down was recovered.

Since trade was contained within the prior day’s there is nothing new technically.

The NQ futures were higher by 27 on the day and are just below the key 4/8 midpoint of the Murrey math box.

The 10-day Trin remains loaded with oversold energy and buying power.

The NDX continues to show relative strength vs. the SPX.

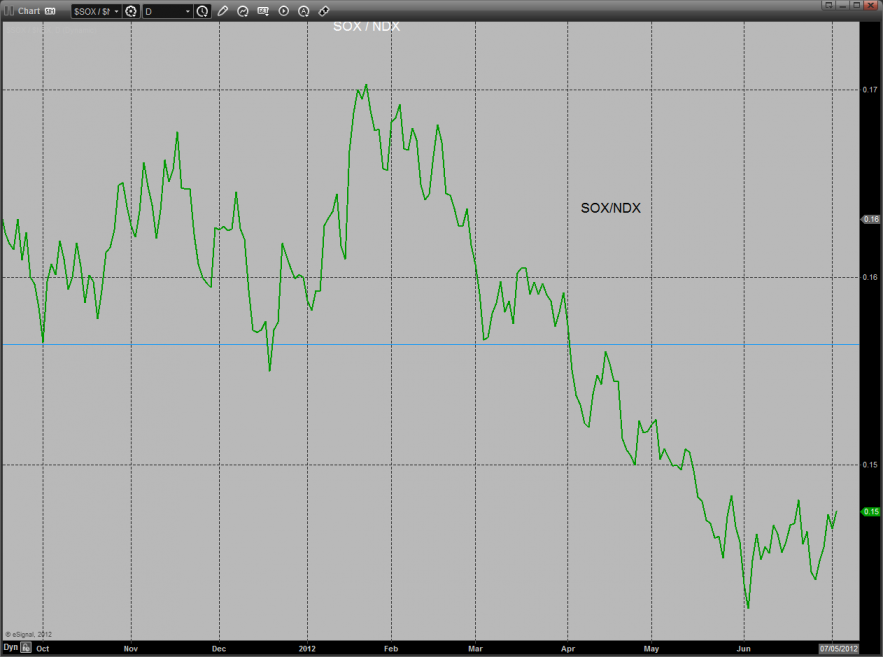

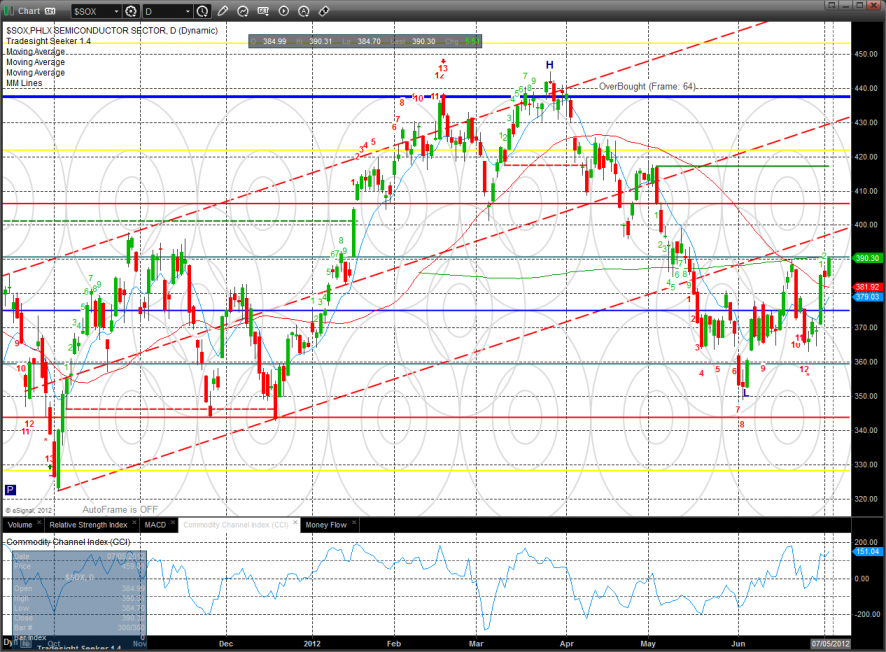

The SOX/NDX cross is getting closer to a bullish change in trend. Keep a close eye on this chart for a higher high.

The Dow/gold chart has yet to breakout which would be a huge buy signal for the long term equity bulls.

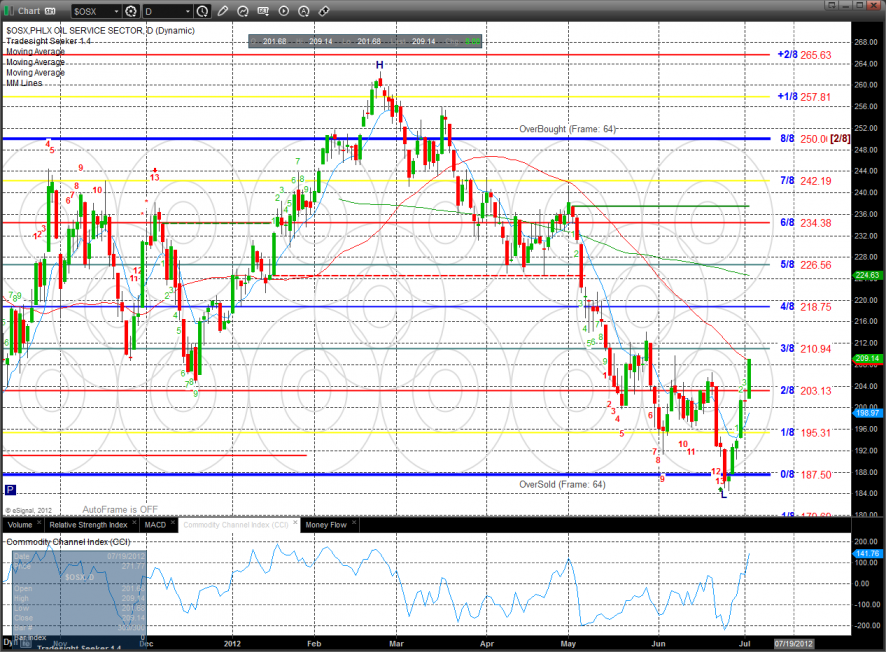

The OSX was top gun Tuesday making good on the Seeker 13 exhaustion buy signal. A close above the 50dma will get the attention of the media and many closet oil bulls. The next real challenge will be the 4/8 level up at 218.

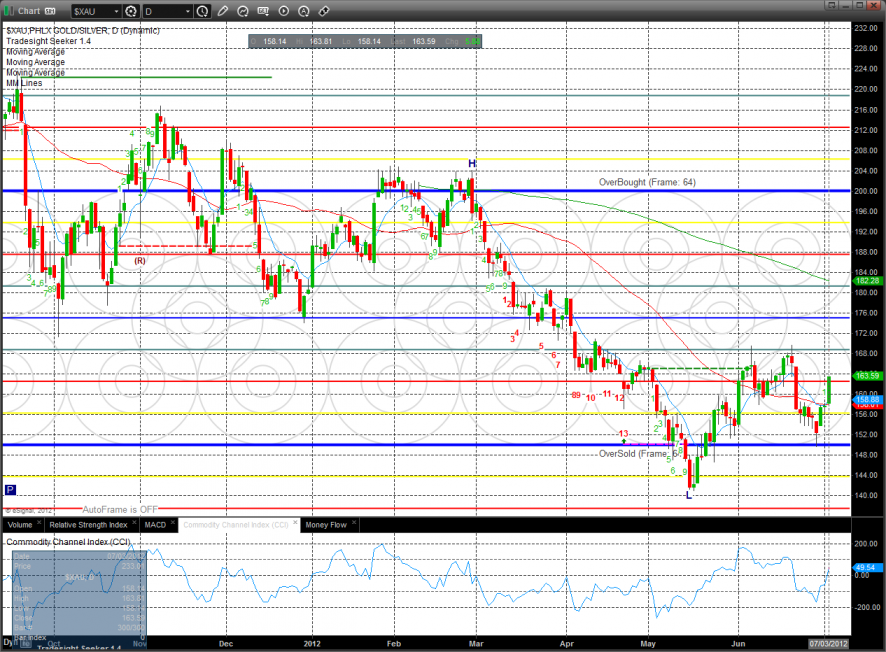

The weak sensitive XAU could be making a higher low but won’t be qualified until a close above the June high.

The SOX closed above the June high and right at the 200dma. Note that the Seeker still has not yet recorded a buy signal.

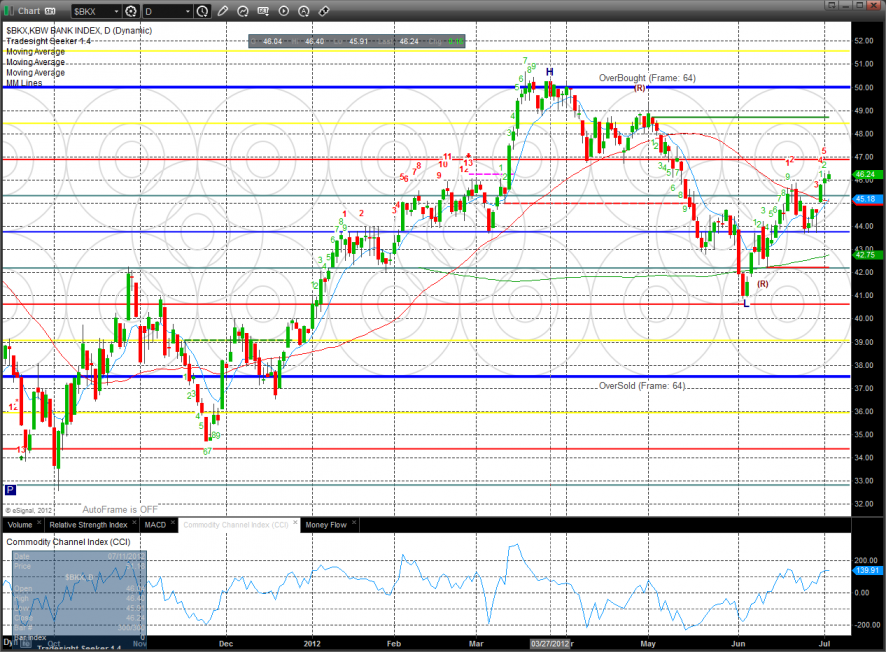

The BKX made a new high but unimpressively so. The next important level is the 47 level which is the April low and May breakdown.

Oil:

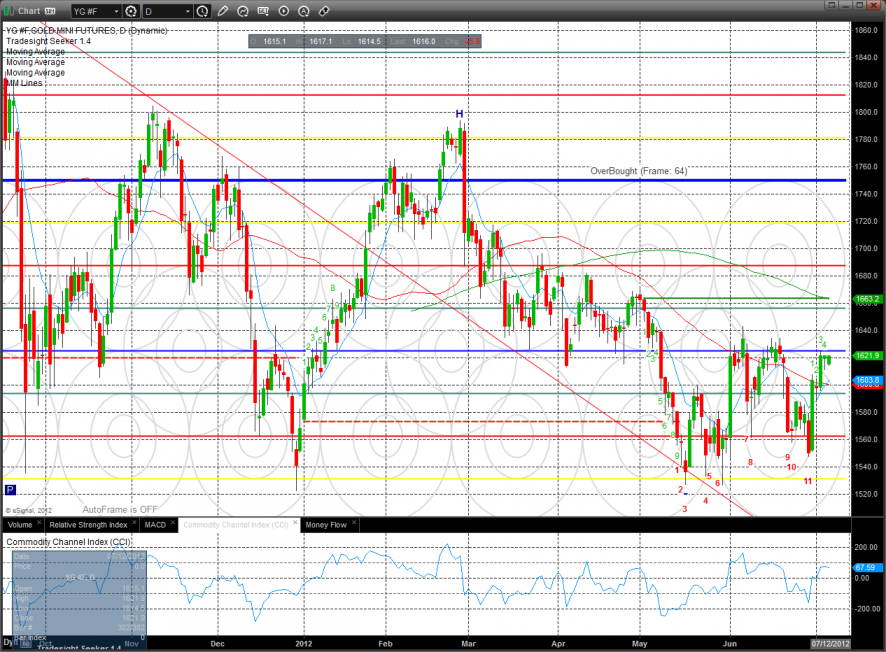

Gold:

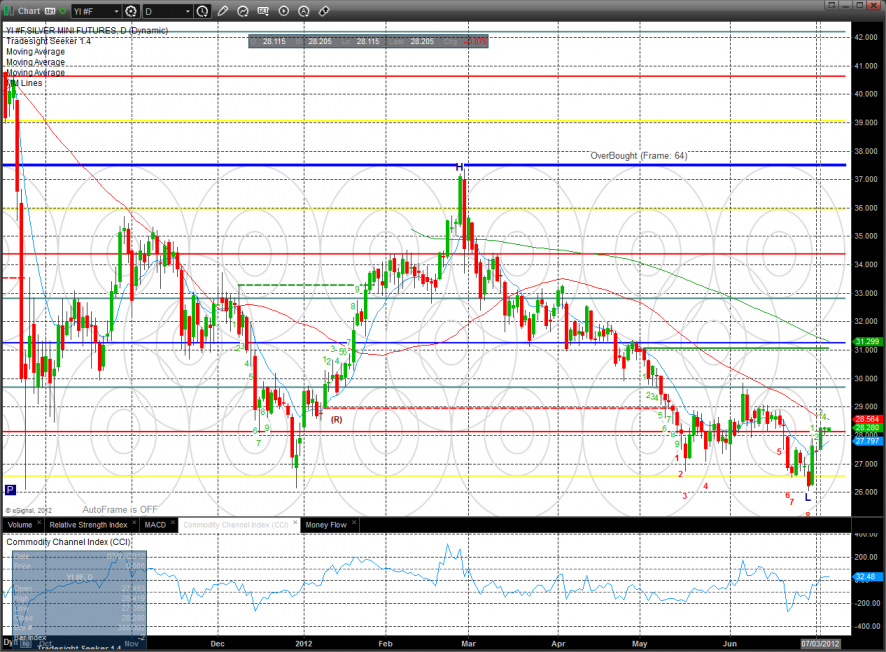

Silver: