The SP lost 14 on the day after recovering bigger losses from a large gap down. Price settled near but under the midpoint of the trend channel.

Naz was lower by 6 on the day and there was one interesting nuance. Price traded at a new high on the move but settled lower. Note that the upper boundary of the channel was tested.

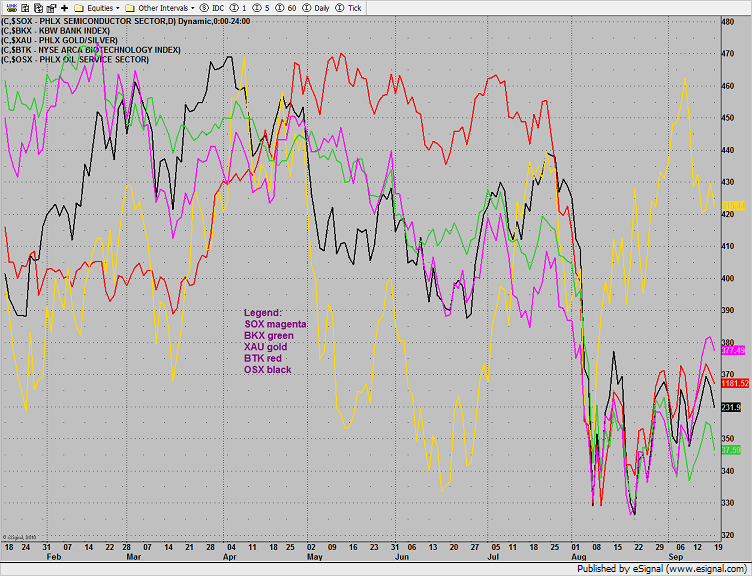

Multi sector daily chart:

The put/call ratio rebounded from an extreme low on the expiration.

The BTK was the top sector though it was still lower on the day. The pattern is getting mature and price is nearing the apex.

The XAU was stronger than the broad market and still above all the major moving averages.

The SOX settled right at the upper trend channel and was in-line with the performance of the Naz

The oil services stocks are nearing the break point of the triangle. The move on the exit of the pattern should be tradable.

The BKX was weak and is still scratching for the Seeker exhaustion signal.

Gold is working lower in price and nearing the 4/8 Gann level at 1750.

Oil was lower on the day, breaking below the triangle.