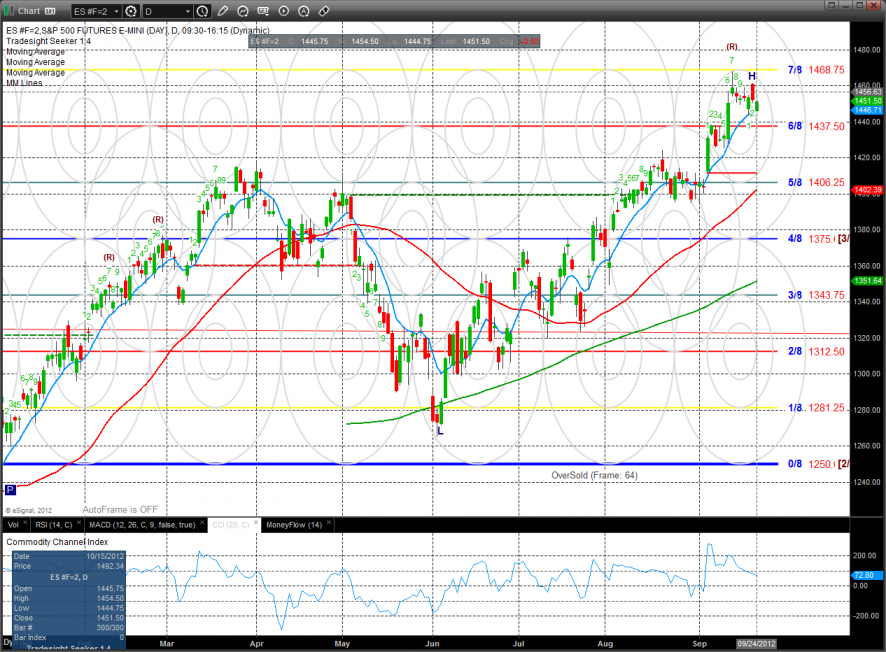

The SP gapped down in the neighborhood of the LPT and was able to close the gap and ultimately settle flat on the day. This is a technical win for the longs because of the large gap if the bears wanted to press the opportunity was there. Price is still above the short-term trend defining 10ema.

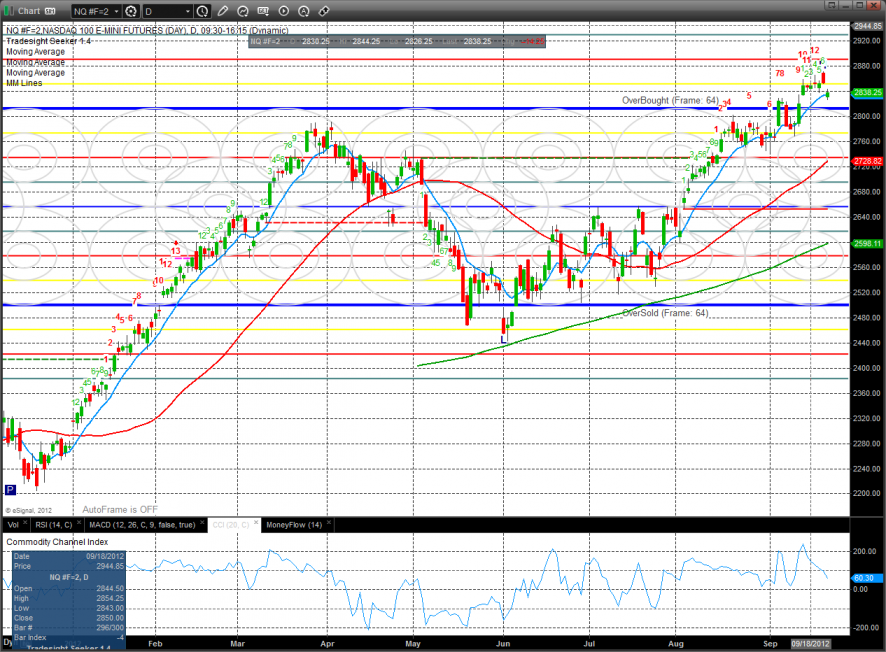

The NQ futures also settled above the 10ema but did not close the gap and closed down 14 on the day. Note that the Seeker count is only one strong candle away from an exhaustion signal.

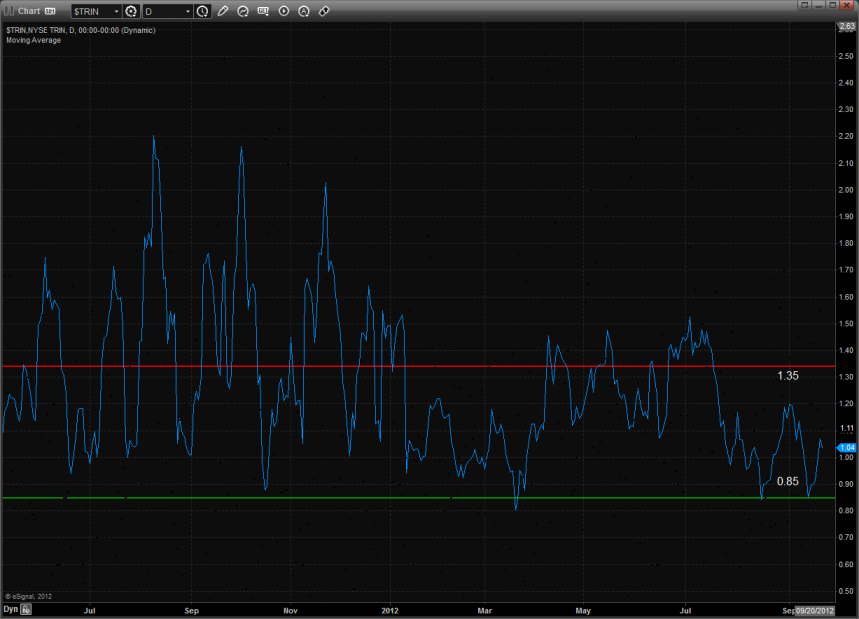

10-day Trin:

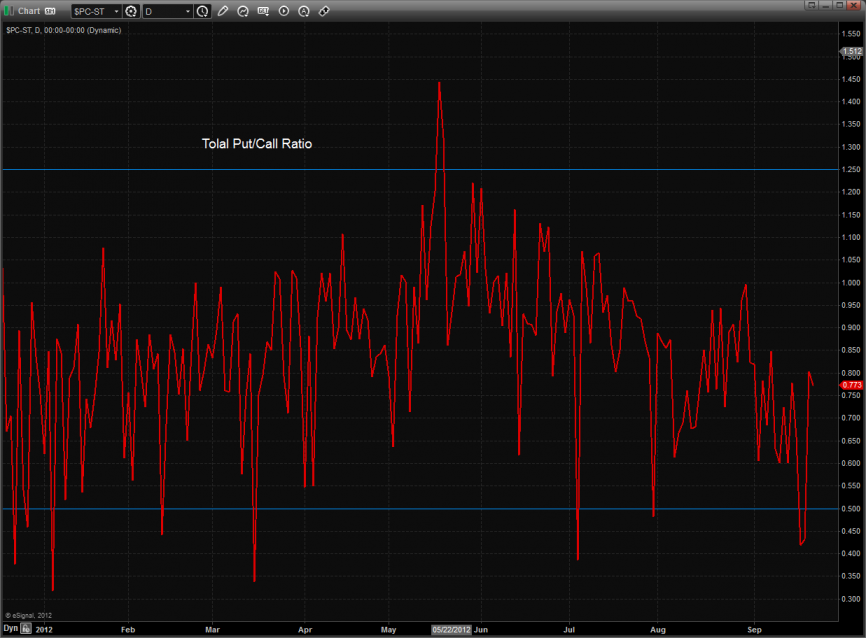

The total put/call ratio has recently recorded a climatically bullish reading.

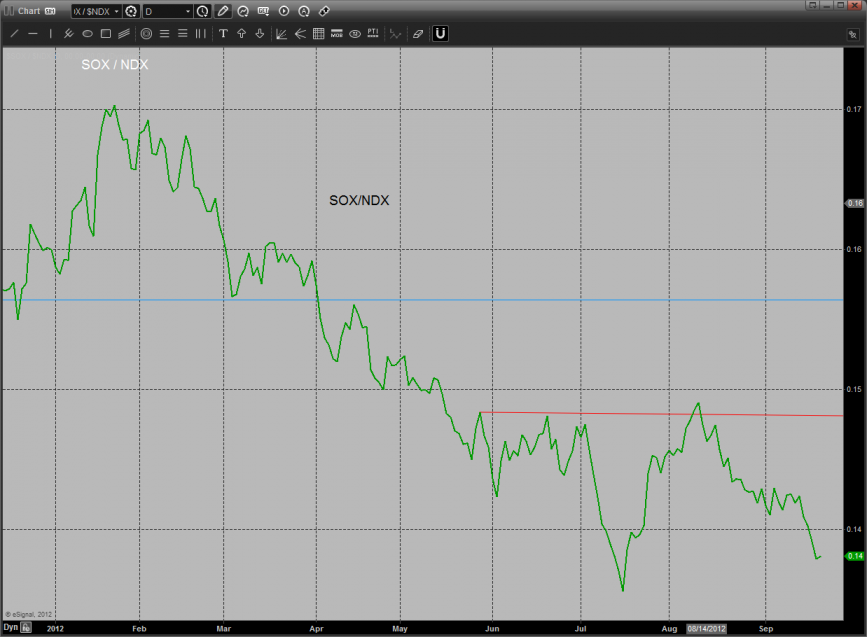

The multi sector daily chart highlights the relative strength of the BTK sector and weakness of the SOX.

The SOX/NDX ratio chart shows the bearish and sustained underperformance of the SOX. If the ratio breaks to a new low then the overall NDX is likely going to tank.

A breakout in the SPX/TLT cross would be bullish for the broad market but the ratio is currently retreating indicating more conservative flows for new money.

NDX/SPX cross is neutral:

The BKX was the top major sector on the day, taking a bounce off the key 8/8 level. Note how the breakout above the March highs is still holding.

The BTK was slightly lower on the day but is still well above the 10ema and looks poised to challenge the 8/8 level.

The OSX was weaker than the broad market:

The XAU suffered a major distribution day off of range high. The trend will turn negative on a close below the 10ema.

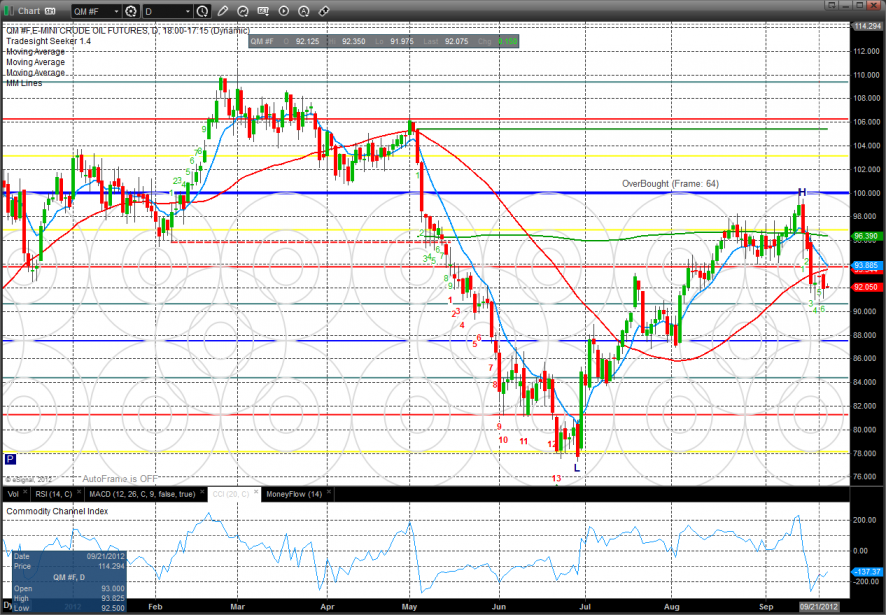

Oil:

Gold:

Silver: