There has been a lot of discussion this week about the state of the economy and what the GDP and Unemployment/NFP data that came out during the week means. Certainly, from the media’s preferred perspective of “scare and fearmonger,” the headline numbers of both could be construed as bad. For the record, the official unemployment rate rose from 7.7% to 7.9%, and the annualized rate of economic growth in the last quarter of last year was a negative number. It came in at -0.1% instead of the expected 1.1%. Keep in mind that while the economy still grew at a 2% or so clip for the total 2012 calendar year, the negative number in the last quarter must imply that things are slowing down, right?

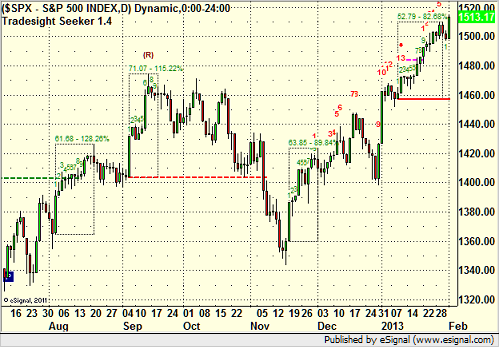

And yet, here’s the S&P today, having received and absorbed both of those data points:

So what gives? Has the market become disconnected to reality? Are the 12 people that have any money left in this country and control the markets just buying things up rub our noses in it? Or is everything as it always has been, which is to say that the market knows everything and behaves accordingly and is getting it right?

My vote is for the latter. I’m a market person. I believe in markets. I believe in trade and capitalism…with rules. Or, anyway, I like to think of them more as guidelines. But, I do believe that the market doesn’t get things wrong. It may get shocked once in a while from information it could not have had, but it prices correctly, no matter how few people are in it.

So what’s the deal then at this point? The economy is shrinking and unemployment is on the rise! Surely this is a bad indication under any measurement.

Let’s first caveat away the actual unemployment rate, because I’m in the camp that says that it is almost useless. Let’s face it, the number of people that would like to work more and make more money, whether they be unemployed, part-time employed, or under-employed, is way higher than 7.9%. But, at the same time, there is always an unemployment rate, and a higher number of “under employed.” Almost separate from the economic collapse here in the US, we were going through a process of outsourcing jobs, and between that and technological improvements, I’m not sure we’re near a place that employment will be back to numbers we are used to for a while. At the same time, when people give up looking for work, they drop off the Labor numbers, and unemployment dips. So the irony is, if people have been out of work but suddenly believe there might be jobs, the unemployment rate can rise as they put themselves back into the “looking for work” camp. It’s a survey, folks. Think about it.

So, from that perspective, since we didn’t LOSE jobs in January, the rise in unemployment at the headline level might mean that people think they have a better chance of getting a job now than previously. Little 0.1 and 0.2 percent moves in unemployment are “noise” just for that reason. Don’t get excited. Don’t get depressed.

Did the economy create jobs in January? Yes. The initial belief is about 157,000 jobs. Are those private or public jobs? Mostly private. Here is an interesting fact.

In just about every recovery in the United States in the last 100 years, part of that recovery has been due to higher levels of government employment. This was true under Reagan, Bush (the first), Clinton, and Bush (the second), just to name a few. It has NOT been true under Obama, something that is often reported incorrectly. But, facts are easy to come by if you want to actually look them up.

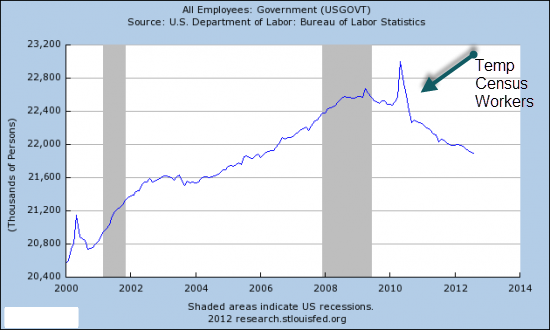

The Bureau of Labor Statistics has the number of employees of all areas of US government charted. It’s pretty clean and easy:

Note that the spike in 2010 was due to the usual once-per-decade staffing up of Census workers, and then those jobs were gone. So when we say that jobs are being created, they aren’t government jobs.

In fact, if you break down the report, you find that the jobs were mostly in Construction, Retail Trade, and Healthcare.

OK, fine, so how does that 157,000 number compare to historic averages? Let’s take seasonality out of it and just look at a bunch of January’s for job creation, going back to 2003:

January 2003: + 95,000

January 2004: + 162,000

January 2005: + 137,000

January 2006: + 283,000

January 2007: + 236,000

January 2008: + 41,000

January 2009: – 818,000

January 2010: – 40,000

January 2011: + 110,000

January 2012: + 275,000

January 2013: + 157,000

First of all, look at January 2009, the month where Obama was sworn in the first time. 818,000 jobs lost! In a month? Are you kidding me? OK, ignore that year, let’s average the prior 6 January’s. What do you get?

159,000.

Thing is, there is always talk from some about “I’m going to do this and that and unleash the economy and grow a million jobs per month.” It’s not going to happen, under any circumstances. That isn’t how it works. On average, the current number is a respectable number, and when you realize that it was all private sector and not a mix, like we usually would see, well, it’s pretty good.

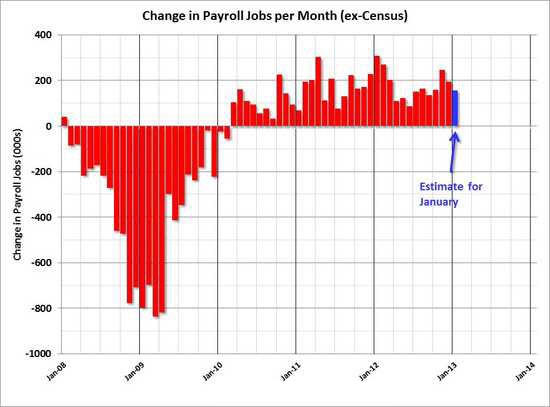

OK, so let’s put the seasonality back into it and examine the monthly jobs data over the last five years (starting when the economic recession that led to the banking collapse started right at the end of 2007, beginning of 2008). Barry Snyder have that data too, including Friday’s new number:

Hmmmm. Man, all I keep noticing is how bad the job losses were in late 2008 and early 2009. So, when you compare that to the 35-months-in-a-row job creation cycle we’re on, does that look bad? No, in fact, the number on Friday looks pretty solid and the general trend is decent. And again, all of this without expanding the public sector rolls because no one seems to think that doing that is OK anymore, even though it is what helped us get out of much smaller economic dips previously.

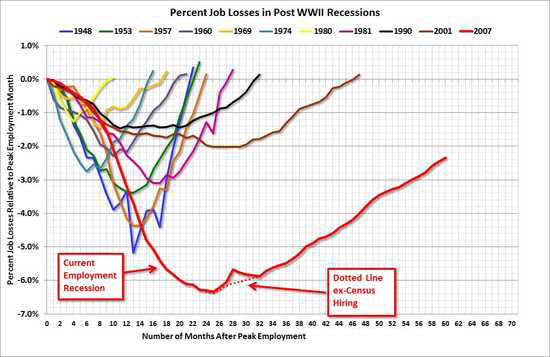

How bad was this dip, by the way? If you’re wondering if there is a way to put the job loss from the start of the financial meltdown into perspective, it turns out, there is. These lines each represent periods of job loss in the US since World War 2. The color is marked at the top and tells you which recession started in which year. You then can see the percentage loss of jobs in the economy, and the line doesn’t end until the job numbers get back to where they were before the job losses began.

The current financial meltdown is the red line:

Wow again. Just brutal. The sad thing is, the second longest line is the brownish one, and that started in 2001 and took almost 4 years to get back to square one. This one starts less than four years later…and is worse. Not exactly the best decade for US employment. No wonder people are saving instead of investing (which doesn’t grow us either). You might even call it a Lost Decade.

Which then takes us back to the GDP (Gross Domestic Product) data that came out this week. This was the first look at the data for Q4 from last year. The top line number, as I said earlier, came in at an annualized -0.1%. If you get two quarters in a row of negative annualized growth, it is considered the start of a recession.

So isn’t that a bad number?

Again, not so fast.

The consumer side was quite healthy, growing at over a 2% clip. What knocked the number down was the dramatic cuts in Federal spending, particular out of the Pentagon. Remember that in their infinite wisdom, Congress and the White House worked out a plan two years ago that if they couldn’t come to terms on budgets by the end of 2012, there would be mass cuts equally in Defense and Domestic Spending.

What we see in this data is that the Defense Department cut back a lot of spending in Q4 (none of which included jobs, just material) to try to prepare for the sequestration (forced cuts) that might be looming so that they could spread out the damage. By doing that, it cut into the economy and knocked the net GDP number down. Now, with the end of year deal, the sequestration is delayed until April, which means that the Defense Department will probably continue the same path. In other words (and isn’t is amazing that suddenly they can cut spending), the Defense Department is trying to find ways to spend less without cutting jobs, hoping that this gets resolved, and they still have their full workforce. But of course, if sequestration does actually kick in, the next piece will not only be less spending, but layoffs, basically guaranteeing a new recession.

In other words, just like we learned out of Europe, austerity doesn’t fix a recession. It makes it worse. Instead of just agreeing to in general a minor set of across the board spending cuts and some tax increases that would point the income and spending sides of the ledger back toward each other over time, Congress is forcing a path toward austerity if they don’t work this out.

But here’s the point. The market doesn’t seem to care. Why?

Same reason that I didn’t think the market would care much about the end of year fiscal cliff situation…unless we really didn’t fix it. The market doesn’t believe that people in Congress are that stupid. Stupid, but not that stupid. It may end up being that this ultimately is one of those surprise shocks to the market when it ends up being wrong if they actually do take us down the road of sequestration. That would send us back to much higher unemployment for the THIRD time in barely a decade, and I’m not sure the economy can sustain that at any level.

So really, what the market is saying is, look, employment is growing at a decent pace in the private sector, and could be doing even better if we were adding some jobs in the public sector as well as we usually do in these cases. The economy is actually growing, although the Pentagon is being proactive and trying to offset some future massive cuts by scaling back in areas without laying people off, and those cuts had a surprise impact on Q4 GDP, although without the impact that making those cuts a permanent deal would be. And in the end, is anybody really going to be dumb enough to trigger the sequestration and really jam the country down that road, which is totally unnecessary? The market is saying that it doesn’t think it will happen, and that right now, if they get through it, the economy is strong enough and doing at least as well as can be considering what just happened a mere 4-5 years ago.

So is the market right? At the moment, I would say yes. Because the market said that Congress and the White House would not take us over the Fiscal Cliff January 1, and they didn’t. Likewise, it seems unlikely that we are going to completely destroy the US economy in the months ahead. But, is there still room for things to happen that the market is being too optimistic about? You betcha.

By the way, even if the market does pause or pull back here after the run up that it has had recently, I leave you with this analogy. If someone runs a marathon and then decides to rest, does that mean they are out of shape?

Trade well.